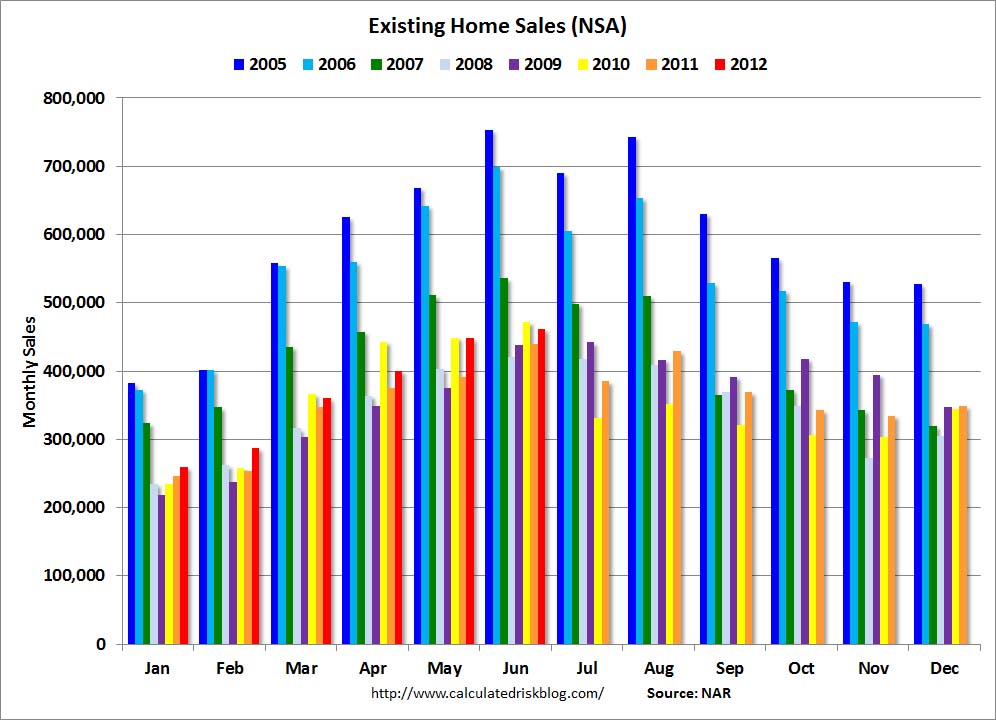

Chart via Calculated Risk

The Housing Recovery is awesome — until you actually look at the sales data.

Then, not so much.

The NAR notes that “Distressed homes – foreclosures and short sales sold at deep discounts – accounted for 25 percent of June sales (13 percent were foreclosures and 12 percent were short sales), unchanged from May but down from 30 percent in June 2011.”

Hence, a huge drop in distressed sales pressuring prices (which would have caused even more distressed sales) is an artificial benefit of the voluntary foreclosure abatements — which have now ended.

The present RRE situation can be best described as massive Fed stimulus + government induced foreclosure abatements = some stabilization.

Anything beyond that statement falls between wishful thinking and a guess. . .

Source:

Existing-Home Sales Constrained by Tight Supply in May, Prices Continue to Gain

NAR, June 21, 2012

http://www.realtor.org/news-releases/2012/07/june-existing-home-prices-rise-again-sales-down-with-constrained-supply

What's been said:

Discussions found on the web: