Our focus today is on the never-ending EU debt crisis, China’s slowdown & the declining corporate earnings we see queuing up in Q2.

Asian markets (ex-China) have been on quite the downtick, falling for a 6th consecutive day.

The Euro dropped below 122 versus the dollar, showing that in the land of the blind, the one-eyed man is king.

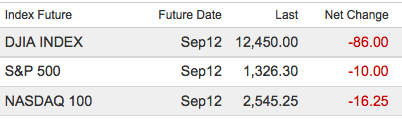

There was no magic bullet in the FOMC minutes, and without that shot of Redbull coming markets in the US look tired and pressured.

European markets also fell, as half hearted central banks stimulus measures failed to arouse traders animal spirits.

We continue to monitor the global economy for further signs of deterioration.

What makes this environment so challenging is that without the certainty of another round of QE investors are more likely to be risk off. Whats preventing this from becoming a rout — see our discussion on the final hour of trading rally each day — is the fear of getting caught under-invested or (heaven forbid short) when the next Ben Bernanke helicopter drop flies into town . . .

What's been said:

Discussions found on the web: