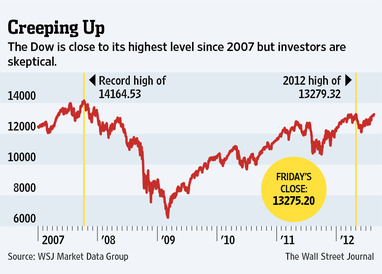

The Wall Street Journal – Epic Stock Rally Finding Few Fans

“This is the most disrespected rally I’ve ever seen,” says John Buckingham, who manages about $100 million in two equity funds as chief investment officer at Al Frank Asset Management in Aliso Viejo, Calif. Sluggish trading volumes and continued outflows suggest few investors are eager to hop on board. The main underpinning of the recent move, many investors say, is the belief that the Federal Reserve will announce a new round of quantitative easing to juice the economy, possibly as soon as September. Some investors also are anticipating the European Central Bank will pump money into the region’s troubled financial system.

Comment

The idea that this is the most hated rally in history has come up before. It’s an interesting concept, but simply not true.

The next two charts shows the results of a survey of stock market newsletter writers conducted by Investor’s Intelligence. The first chart (green) shows the percentage of bullish newsletters. The second chart (red) shows the percentage of bearish newsletters.

Neither chart is close to an extreme reading. The 2009 and 2010 rallies were more “disrespected” than the current rally.

Stock market bulls would like to believe raging bearishness is enabling stocks to climb a wall of worry. Unfortunately this just isn’t the case.

Click to enlarge:

The Financial Times – Investors baffled by subdued Vix level

Simultaneously, the market for products that protect against stock market falls has gone unusually quiet. In fact, the Vix index – a measure of investor expectations of volatility commonly known as Wall Street’s “fear gauge” – has been indicating unruffled confidence. On Monday, the Vix closed at a five-year low of 13.7, down 60 per cent in 12 months. “We’re scratching our heads,” says Maneesh Deshpande, head of US equity derivatives research at Barclays. “When the market is rallying like this we expect investors to be saying let me protect my downside, but the amount of hedging has been very limited.” The durability of the summer’s rally may hinge on whether investors have become complacent about risk. If investors have bought into stocks aggressively and without protection, a small sell-off could quickly accelerate.

Comment

Below is the chart showing the VIX. If this is the most hated rally in history, as speculated, we would expect to see a high VIX, not a 5-year low.

Again the idea that this is a hated rally is simply not true.

Source:

Bianco Research

For more information on this institutional research, please contact:

Max Konzelman – max.konzelman@arborresearch.com

800-606-1872

What's been said:

Discussions found on the web: