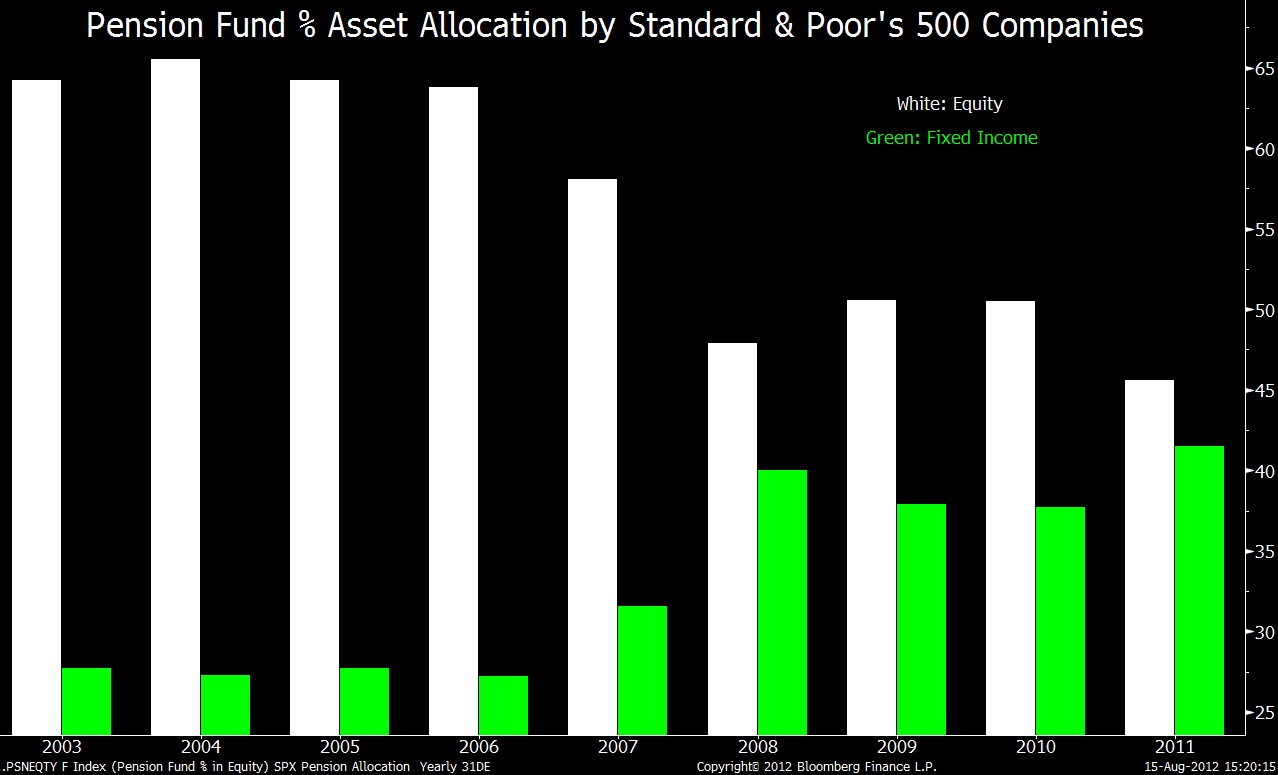

Click to enlarge:

Source: Bloomberg

Corporate pension plans probably will sustain a shift away from stocks and toward bonds that has occurred during the past five years, according to David Bianco, Deutsche Bank AG’s chief U.S. equity strategist.

The chart above displays the year-end percentages of pension-plan assets invested in equities and fixed income since 2003 for companies in the Standard & Poor’s 500 Index. The data were compiled by S&P’s Capital IQ Compustat unit and cited by Bianco in a report two days ago.

Stocks amounted to 46% of S&P 500 plan assets at the end of last year. The allocation was 12 percentage points lower than in 2007, during a housing-driven bull market. Bonds were 42 percent of assets, a 10-point increase over the same period. Real estate and other assets accounted for the balance.

“It is unlikely that the trend of diminishing equity allocations reverses,” Bianco wrote. He cited two reasons for the conclusion: the closing of many plans to new workers, which limits the amount of time plans have to invest, and accounting changes that make funding gaps easier to track.

S&P 500 pension plans have a $325 billion total deficit, according to Bianco, based in New York. Although this gap has narrowed from $355 billion at the end of last year, lower bond yields are hurting returns, the report said. The yield on the Barclays Capital U.S. Aggregate Bond Index has been as low as 1.71 percent in 2012, down from 2.24 percent when 2011 ended.

Companies outside the S&P 500 may be even less committed to stocks than those in the index. Only 32 percent of pension assets in the U.S. were invested in equities when last year ended, according to the Federal Reserve. Forty percent was allocated to bonds.

BR Note: I am unconvinced, but I thought this was worthy of further discussion.

Source:

Bloomberg

By David Wilson

August 16, 2012

David Bianco

Deutsche Bank

What's been said:

Discussions found on the web: