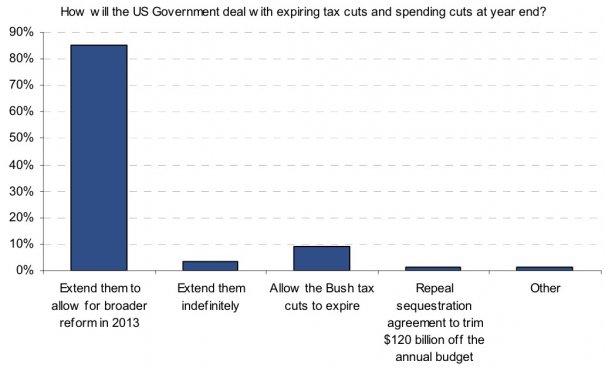

Click to enlarge:

Source: Bianco Research

The Wall Street Journal – ‘Fiscal Cliff’ Has Many Perils

The U.S. economy likely would slide into a “significant recession” next year if Congress doesn’t avert tax increases and spending cuts set to begin in January, the Congressional Budget Office said Wednesday. But if they are postponed for at least a year, the federal government faces the prospect of a fifth straight year with a budget deficit greater than $1 trillion, the CBO said…The CBO painted two starkly different scenarios for next year, depending on which path lawmakers take. Under current law, the Bush-era tax cuts are scheduled to expire at year-end, raising tax rates on more than 100 million Americans. These tax increases, combined with roughly $100 billion in required spending cuts on military and other government programs, would shrink projected deficits from $1.13 trillion in the fiscal year ending Sept. 30 to $641 billion for the year that ends Sept. 30, 2013. That would reduce the deficit from roughly 7.3% of the nation’s gross domestic product to roughly 4% of GDP, the CBO said, the largest one-year reduction since 1969. But as a consequence, the economy would contract at a projected annualized rate of 2.9% in the first half of 2013, and by 0.5% over the entire year. The unemployment rate would rise to 9.1% at the end of the year from just above 8% now, the CBO estimated. If Congress were to postpone the tax increases and spending cuts, the deficit would shrink just slightly in the next fiscal year, to $1.037 trillion, or 6.5% of GDP. The unemployment rate at the end of 2013 would be 8%, a difference of roughly two million jobs from the other scenario, CBO said. The economy would grow by 1.7% over the year.

Comment

As we noted earlier this week, 86% of clients surveyed by Citi think the fiscal cliff will amount to nothing. Our experiences suggest that percentage might low low as nearly 100% of our clients think the fiscal cliff will amount to nothing.

In other words, almost nobody has discounted the possibility of a complete breakdown in fiscal negotiations.

Count us among the vast majority who think nothing will come of the fiscal cliff. However, if this forecast is wrong, it will matter to the markets because the downside has not been discounted.

For more information on this institutional research, please contact:

Max Konzelman

max.konzelman@arborresearch.com

800-606-1872

What's been said:

Discussions found on the web: