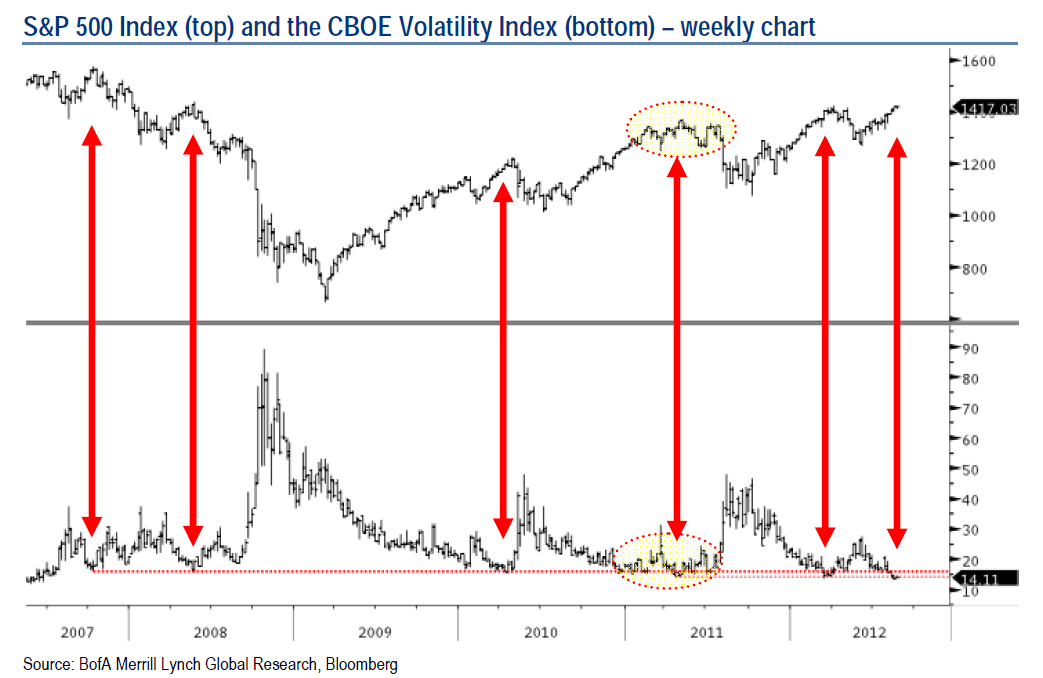

VIX five-year pattern suggests a complacent equity market

Source: BofA / Merrill Lynch Market Analysis

Over the last five years, readings of 16 to 14 for the CBOE Volatility Index (VIX) have indicated complacency in the US equity market. Based on the chart below, prior declines to 16-14 in the VIX coincided with peaks in the equity market in October 2007, May 2008, April 2010, during the December 2010 to July 2011 period, and April 2012. Moving into late August, the VIX has already dropped to as low as 13.32 on 17 August, which was the lowest level since June 2007. In our view, a low VIX is increasing the risk of a meaningful pullback during the seasonally weak month of September – see the side bar for seasonal stats on the S&P 500.

What's been said:

Discussions found on the web: