Fascinating set of cycle charts from Merrill looking at earnings, and how being too early when timing value stock purchases is even worse than being too late!

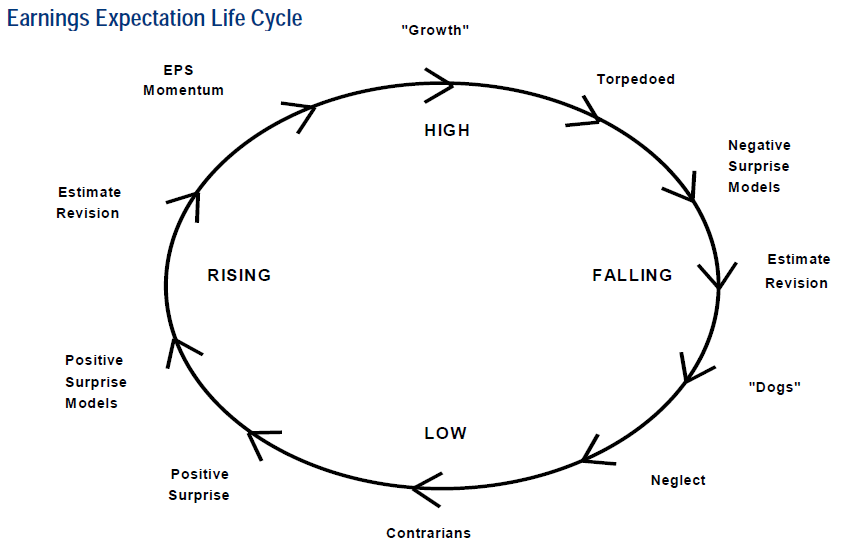

Earnings Life Cycle

Click to enlarge:

Merrill explains:

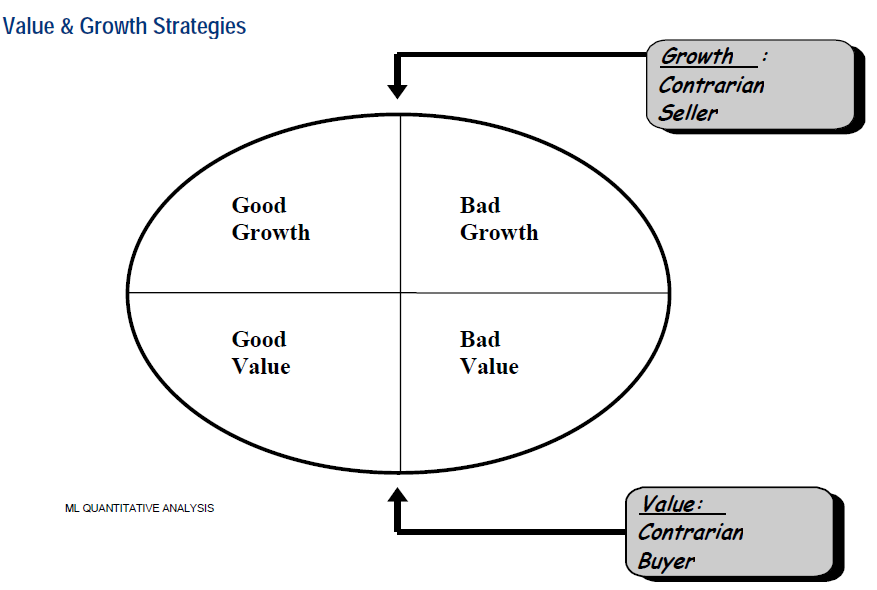

“Value traps are industries that fall into the portion of the earnings expectation life cycle labeled Bad Value. These are industries that are selling at discounts to their historical market multiples, but do not yet appear to have any suggestion of an upturn in price performance.

Our work suggests that the hardest thing for a value manager to do is to buy a stock, and good value-oriented managers are likely to be buying stocks later than their peers. Value managers often like to say that they will buy stocks early but they’ll be there at the bottom. Although that sounds encouraging, the route to value fund underperformance is to buy early too many times.”

Good Value Managers vs. Bad Value Managers

Source:

Value trap alert!

BofA/Merrill Lynch

September 24, 2012

What's been said:

Discussions found on the web: