Early in my finance career, I received some excellent advice: Never buy house product.

At the time, I was on a trading desk, looking for more authority (read more $$) along with the ability to hold open positions longer term. A quid pro quo was offered, where if I purchased more of X, I could obtain more of that sweet, sweet leverage, and a more flexible trading authority.

On the advice of a senior trader, I (painfully) turned down the offer. His advice went something like this:

“Kid, never buy house product. There are a broad variety of financial products in the world of finance. Select the best product, the one with the best performance relative to the risk you assume, lowest fees, and is ideal for your client and/or portfolio REGARDLESS of source. Never buy anything that was created not to serve your specific investment needs, but rather, was designed to capture a greater percentage of the fees charged.”

This turned out to be excellent advice. Regardless of where you are in the finance food chain, doing the right thing never hurt your long term performance or reputation. It may seem obvious, but with the fast money was on the table, there were lots of people who lacked the understanding (or character) to leave it there.

The results were brutal: People who bought house product ran into a number of problems directly related to it. There were regulatory issues caused by shortcuts taken by underwriters. Performance invariably stunk, partly due to excessive fees, but mostly due to the crappy idea underlying the investment. As so many people working on Wall Street discovered to their chagrin, it became nearly impossible to move firms when their clients were buried in house product that was designed to be not particularly portable. It was a painful lesson to many.

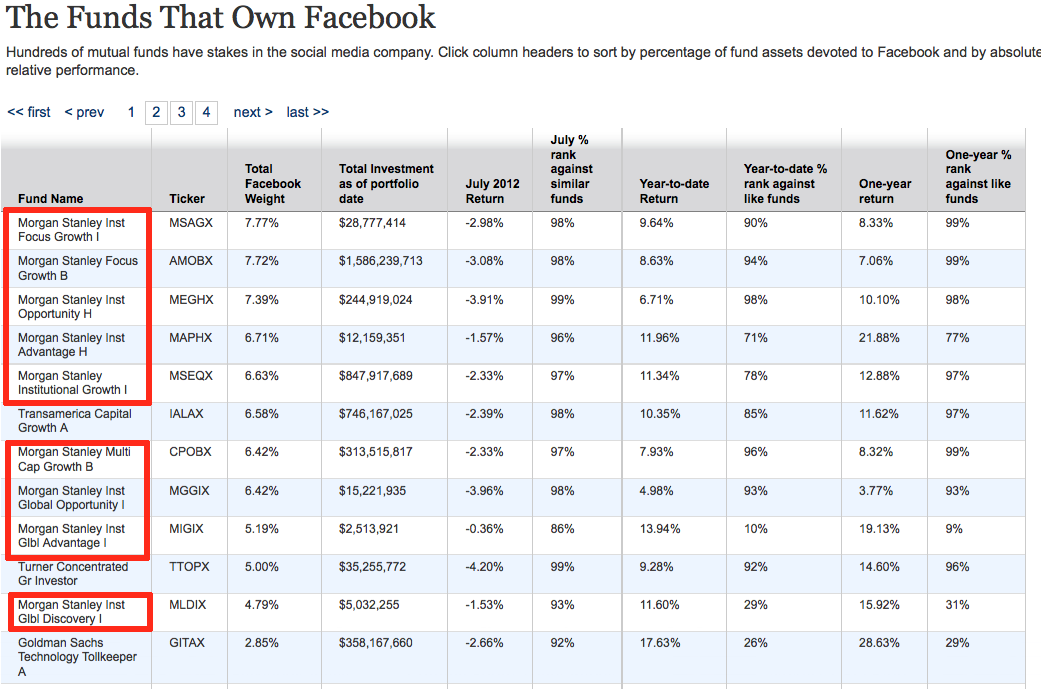

I was reminded of this advice while read a WSJ article on the Facebook IPO (you may have missed it during vacation week). FB is now down more than 50% from its offering price of $38. As it turns out, holdings data revealed that “eight of the top nine U.S. mutual funds with Facebook shares as a percentage of total assets are run by Morgan Stanley’s asset-management arm, according to fund tracker Morningstar“. So the biggest holders of Facebook stock are Morgan Stanley Mutual Funds, and — not coincidentally — Morgan Stanley was the lead underwriter of the Facebook IPO.

Go figure:

Table courtesy of WSJ

There is a broad universe of potential assets any investor can own. The “House” underwritten products — the mutual funds, investment banking deals, private equity/VC offers, SPACs, structured notes, etc. — that are conceived, created and sold in house serve a specific purpose.

I have yet to see a compelling argument as to why anyone –retail stock broker, individual investor, institutional investor — should ever own this dreck, other than pocketing a higher than normal short term fee at the expense of the investor. That, dear reader, is their sole purpose.

There is an obvious lesson here. Why not buy the best you can find instead of the highest fee generating asset? If not for the benefit of the client whom you should be treating with a standard of fiduciary care, than at least for the sake of your own long-term reputation and career prospects?

The people who seem to get into the most trouble on Wall Street are those who are too impatient to get rich slowly . . .

Previously:

Advice for Rich Uncles and Others . . . (August 2007)

Source:

Morgan Stanley Funds in Big Facebook Bet

AARON LUCCHETTI and TELIS DEMOS

WSJ, August 24, 2012, 11:57 a.m. ET

http://online.wsj.com/article/SB10000872396390444082904577607731934429936.html

What's been said:

Discussions found on the web: