Key Data Points

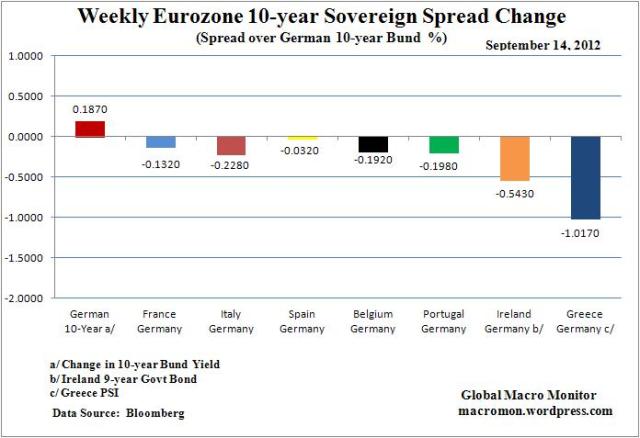

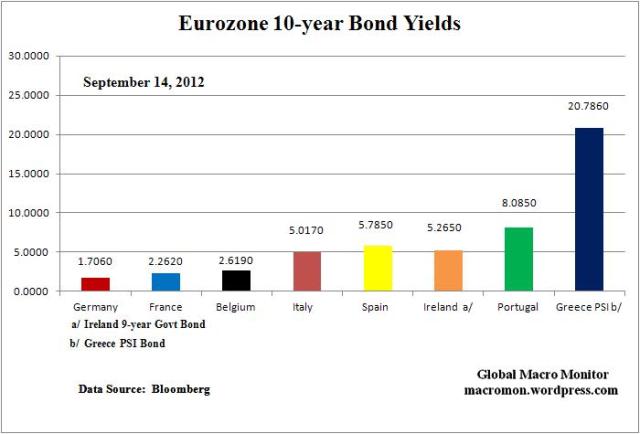

German 10-year Bund 19 bps higher;

Italy 10-year 23 bps tighter to the Bund;

Spain 3 bps tighter;

Portugal 20 bps tighter;

Ireland 54 bps tighter;

Greece 102 bps tighter;

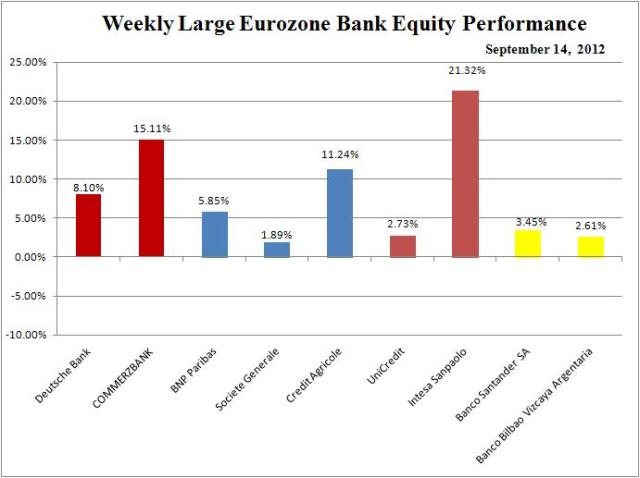

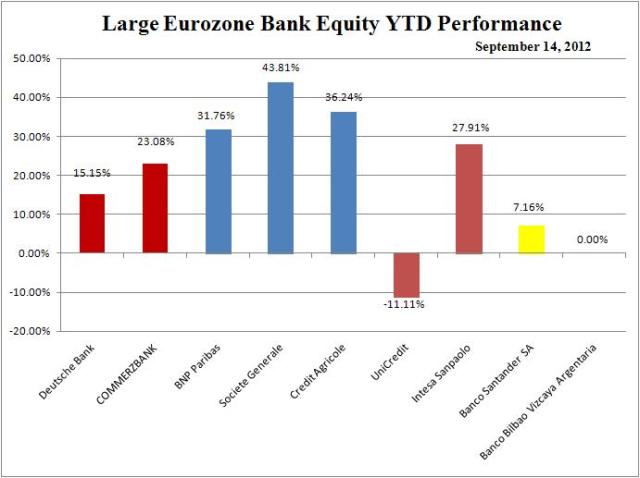

Large Eurozone banks 3-20 percent higher;

Euro$ up 2.7 percent.

Commentary

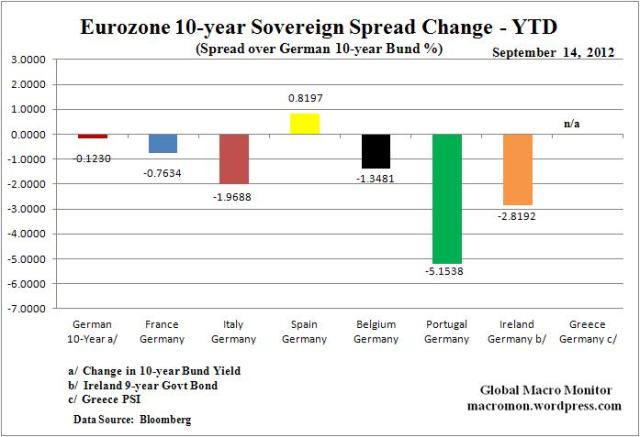

Spreads continue to trend tighter and bank stocks higher. The Euro/$ moved above 1.30 confounding and hurting those betting on move to parity by year-end. Keep an eye on this key price as it will have a huge impact on the competitiveness of the periphery, which is more of a longer run concern, however. To paraphrase Keynes, in the long run we’re all under performers. Europe is coming off the table as a short-term concern that has kept scared money on the sidelines.

Haven’t seen traders this giddy in a long time! Giddy freakin’ up!

(click here if charts are not observable)

(click here if charts are not observable)