Zero Interest Rate Policy (ZIRP) and Quantitative Easing (QEx) have been blamed for everything from the coming dollar apocalypse to imminent hyperinflation to troubles in the Middle East.

I’ve spilled too many words on why Fed intervention is yet another backdoor bailout for banks’ ravaged balance sheets; propping up residential real estate merely delays the inevitable denouement; it prevents the proper allocation of assets; and last, it acts as a stop against a needed de-financialization of the US economy.

Today, as an intellectual exercise, I want to argue for QE.

Why? Call it the lessons of Moot Court. It is one of the more interesting things you can do in law school. You are given a case, with a set of facts and specific laws to apply. As you prepare your case, you may not know even which side you will be arguing for or against. Hence, you have to truly understand the strengths and weaknesses of both sides of the case. You can argue pro or con with far more effectiveness if you truly know what the strengths and weaknesses of the opposing party are. Thus, you avoid the typical confirmation biases that affects most advocates — and investors.

So this morning, I want to take the other side of the trade, and consider what the positives of QE are. I have come up with three simple economic improvements that QE helped create:

1) Housing Improvement

2) Corporate Balance Sheets

3) Manageable Federal Debt

Let’s review them in order.

1) Housing: As you may have noticed, while the rest of the economy has been pretty weak, Housing has held its own. In a note to our asset management clients at the end of Q3, we observed that while Employment, Durable Goods, Income, and Retail Spending were all soft, Housing is actually one of the few bright spots in the US economy.

The reason for that is simple: The Fed’s QE.

Today, you can get a 30 year fixed mortgages at 3.5% (assuming you have pristine credit and a good job history). That is a ridiculously low rate; it has increased a prospective home owner’s buying power by 15%. While home sales and prices still remain wildly below their 2005 record highs, they have stabilized and moved off the bottom. None of this could have happened without the Fed’s action.

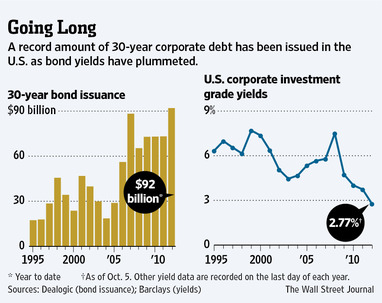

2) Corporate Balance Sheets: The WSJ reported today what most of us have known for awhile: US companies are feasting on the cheapest money in living memory. 30 year investment grade corporate bonds are averaging a mere 2.77%. And, investment-grade companies have sold more 30-year bonds in the U.S. so far in 2012 than in any full year since 1995.

The WSJ:

“Companies are taking advantage of investors’ appetite for yield—and fear of riskier bets—by issuing more long-term bonds, aiming to reduce their refinancing needs in coming years, when interest rates are likely to be higher.

Investment-grade companies have sold more 30-year bonds in the U.S. so far in 2012 than in any full year since 1995, according to data provider Dealogic.

The $91.9 billion of 30-year bonds sold in 166 offerings this year, is about 26% more than the $73.2 billion sold in 145 deals during all of 2011.”

This corporate debt finds its way back to the economy in myriad ways: Dividends, CapEx spending, share buybacks and (yes) hiring.

3) Federal Debt: The trillion dollar annual US deficit spending has created an outstanding debt of over $15 trillion dollars. The only way this is even remotely manageable is by keeping rates so low that the servicing costs are bearable.

If the US had normalized yields, the cost to US taxpayers would be astronomical. Radical spending cuts and tax increases would follow, likely leading to another significant recession.

~~~

That is my pro-QE exercise. (Regular readers know that my heart isn’t in it). And note that I refuse to attempt a Wealth Effect argument, knowing as I do that it is nonsense.

However, if you do not understand what is driving the Fed, it is harder to see when they might actually end the program, with consequences across the economy. To paraphrase an old quip, watch what they do, not what they say. Understanding the positive quantitative metrics they can observe that encourage their ongoing MBS purchases and other quantitative easing can help us anticipate when it will be over. I suspect when we see the preliminary signs that is about to occur, substantial changes to one’s portfolio will be of urgent necessity.

Until then its best to wargame various outcomes, and consider all sides of the argument . . .

What's been said:

Discussions found on the web: