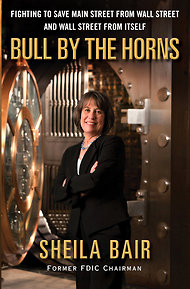

Book Review: Bull by the Horns: Fighting to Save Main Street from Wall Street and Wall Street from Itself.

Book Review: Bull by the Horns: Fighting to Save Main Street from Wall Street and Wall Street from Itself.

By Sheila Bair

Free Press (2012), 415pgs

“Bull by the Horns” is a really excellent book. Former FDIC Chairman Sheila Bair accurately describes the conflicted world of bank regulation in our democracy. Her well-written narrative of the Basel II mess, for example, and how these supposed “capital adequacy” rules, in fact, enabled vast securities fraud and criminality by the largest American and EU banks is very well done. Indeed, this book provides another authoritative view of the degree to which fraud was the root problem on Wall Street.

I have been a friend and at times defender or Chairman Bair during her years at the FDIC and highly recommend this book. Bair’s description of the role of Treasury Secretary Tim Geithner as the passive stooge protecting the Wall Street banks is especially delicious. It is no secret that Bair and Geithner do not agree on many issues, athough she does support the call by Geithner to move forward with regulation of money market funds. Chairman Bair also told be recently that she agrees with Secretary Geithner that the FDIC’s emergency insurance on transaction accounts, known as TAG, should expire at the end of this year. But, in general, Chairman Bair certainly paints Geithner as a complete tool and political naïf when it comes to protecting Citigroup and other large banks.

For example, while Geithner was still at the Fed of New York, he apparently leaked a story to Bloomberg News saying that the new Obama White House would seek to replace Chairman Bair at the FDIC. The story quoted Geithner as saying that Bair was not a “team player.” I heard a lot of the same limp wristed crap from a number of Democratic and bankers economists in that same timeframe. But in an illustration of just how poor is Geithner’s political sense, the move backfired. Both Senate Banking Committee Chairman Christopher Dodd (D-CT) and House Financial Services Committee Chairman Barney Frank (D-MA) immediate wrote letters to President-elect Obama supporting Chairman Bair. The truth was that Bair had then and has today far more credibility in Washington than Geithner will ever possess.

Another interesting aspect of “Bull by the Horns” is Bair’s narrative of the shifting financial fortunes of the FDIC, both with respect to Congress and the media. The evolution of Bair’s stature with the Congress, particularly Richard Shelby (R-AL) and Dodd, is instructive for those who believe in “efficiency” and regulatory consolidation. That FDIC did push back against the efforts by the Fed and other regulator to expand risk-taking by the largest zombie banks is one of Bair’s great accomplishments.

Bair’s tenure proves very nicely that competition among different regulators is an essential part of checks and balances with regards to the corruption of money in our political life. And as she told me many times during her tenure, Bair’s primary job was communicating with the public, Congress and the banks, a role she performed with great effectiveness. As she writes:

“Responsible members of the financial services industry also need to speak up in support of financial regulatory reform. All too often, the bad actors drive the regulatory process while the good actors sit in the sidelines. That was certainly true as we struggled to tighten lending standards and raise capital requirements prior to the crisis. There were many financial institutions that did not engage in the excessive risk taking that took our financial system to the brink. Yet all members of the financial services industry were tainted by the crisis and the bailouts that followed.”

Were it not for the courage of Sheila Bair and her colleagues at the FDIC, and their willingness of openly break with the servile creatures that populate the bank regulatory organs of the Fed and Office of the Comptroller of the Currency, large zombie banks would have complete hegemony in Washington public policy. Bair’s refusal to accept the flawed Basel II framework and insistence on retaining the leverage ratio for US banks is an enormous accomplishment for her and her agency. This book should reinforce the traditional practice of Congress to have multiple independent agencies involved equally in financial regulation. And it is no accident that Bair gives credit to Vice Chairman Martin Gruenberg, a veteran technocrat like Bair who tolerates no nonsense from the banks, large or small.

Americans who want an honest, inside view of our collective failure to avoid the subprime financial bubble need to buy and read this book. As you read this interesting and engaging book, remember that fraud is only possible in a free society. “Bull by the Horns” very succinctly explains why it is so difficult to limit financial fraud and malfeasance by bankers and public officials alike. Her description of the bad acts by apologists for the largest zombie banks, such as NY Senator Charles “Cheese” Schumer (D-NY), is wonderful. I wish more of our public officials used such candor in their statements about the glaring conflicts of Wall Street touts such as Schumer, the chief money man of the Democratic Party.

Sheila Bair is a great American and we all owe her a debt of gratitude for her many years of diligent public service. While appointed figures like Geithner, Hank Paulson and others prostituted themselves to the big banks, Sheila Bair did her job and followed the law. This book sets a good example for future leaders in public life to follow.

Christopher Whalen

www.rcwhalen.com

A shorten version of this review appeared earlier on www.amazon.com