This time of year, newspapers and magazines are filled with predictions and stock recommendations and trading ideas. I have repeatedly explained why these are terrible ideas and you should ignore them.

Sometimes, you just have to let the performance speak for itself. And for that, I present Fortune: 10 Stocks To Last The Decade A few major trends will likely shape the next ten years. Here’s a buy-and-forget portfolio to capitalize on them.

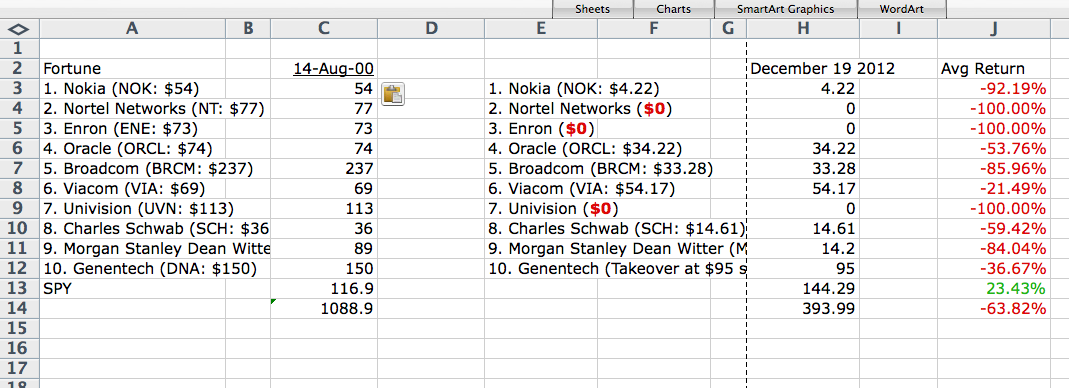

August 14, 2000

1. Nokia (NOK: $54)

2. Nortel Networks (NT: $77)

3. Enron (ENE: $73)

4. Oracle (ORCL: $74)

5. Broadcom (BRCM: $237)

6. Viacom (VIA: $69)

7. Univision (UVN: $113)

8. Charles Schwab (SCH: $36)

9. Morgan Stanley Dean Witter (MWD: $89)

10. Genentech (DNA: $150)

Closing prices December 19, 2012:

1. Nokia (NOK: $4.22)

2. Nortel Networks ($0)

3. Enron ($0)

4. Oracle (ORCL: $34.22)

5. Broadcom (BRCM: $33.28)

6. Viacom (VIA: $54.17)

7. Univision ($? )

8. Charles Schwab (SCH: $14.61)

9. Morgan Stanley Dean Witter (MWD: $14.20)

10. Genentech (Takeover at $95 share)

The portfolio managed to lose 74.31%, with 3 bankruptcies, one bailout, and not a single winner in the bunch. Even the Roche Holdings takeover of Genentech was for 37% below the suggested purchase price. The lesson is that valuation matters.

(Update: Forgot about Univision takeover — I’ll pull the TO price and recalculate when I get into the office)

(Update 2: Yeah, I forgot about Oracle 2 for 1 split — I’ll adjust that as well Broadcom 3 to 2 split)

Had you merely bought the S&P500 index via the Spyders, you would have seen a gain of 23.43%.

Have fun forecasting!

Previously:

Apprenticed Investor: The Folly of Forecasting (TheStreet.com, 06/07/05)

2008 Investment Guides Are HILARIOUS (December 31st, 2008)

UPDATED: Worst Predictions for 2008 (December 31st, 2008)

Investing in 2012: Get ahead of forecaster folly (WaPo, December 30 2011)

Source:

10 Stocks To Last The Decade

By David Rynecki FORTUNE Magazine, August 14, 2000

http://money.cnn.com/magazines/fortune/fortune_archive/2000/08/14/285599/index.htm

What's been said:

Discussions found on the web: