Key Data Points

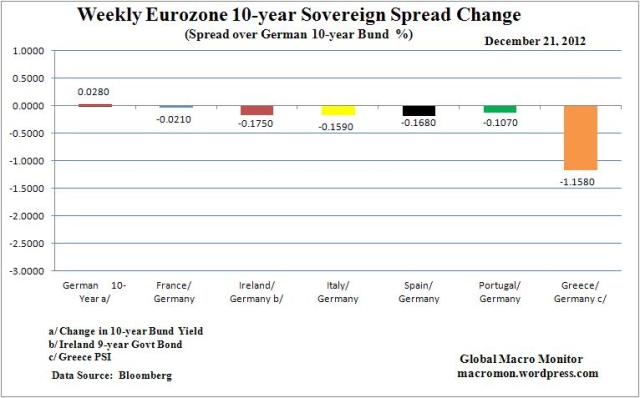

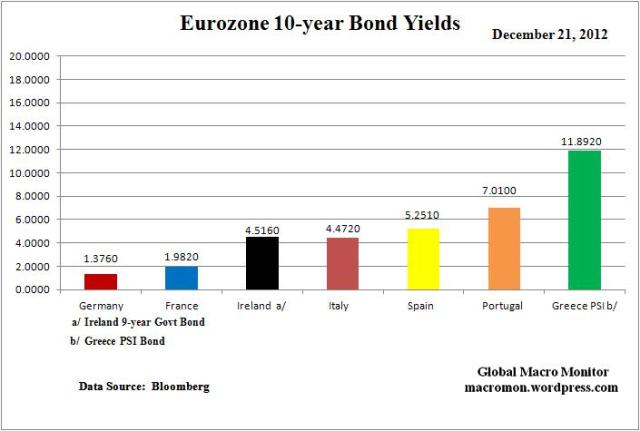

German 10-year Bund 3bps lower;

France 2 bps tighter to the Bund;

Ireland 18 bps tighter;

Italy 16 bps tighter;

Spain 17 bps tighter;

Portugal 11 bp tighter;

Greece 116 bps tighter;

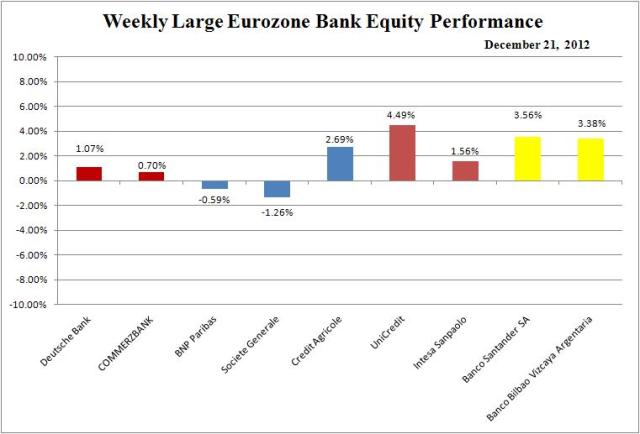

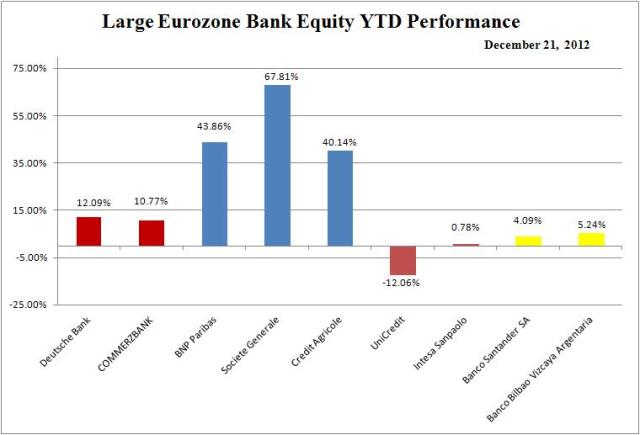

Large Eurozone banks up -1.0 to 5.0 percent higher;

Euro$ up 0.17 percent.

Comments

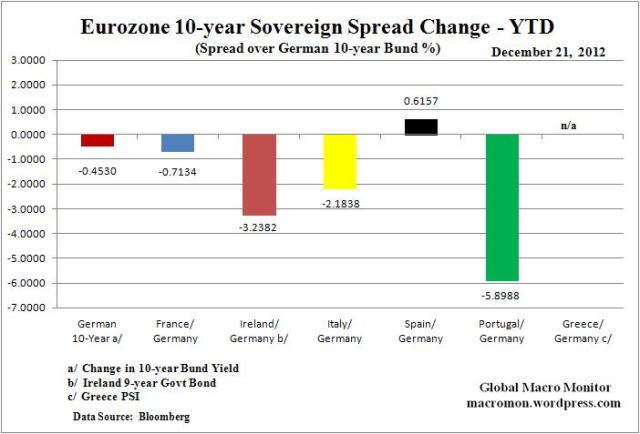

– Italy, Portugal, and Greece 10-year yields at lowest weekly close of the year;

– Greece was upgraded five notches to B- by Standard & Poor’s;

-Ryanair said it’s opening its first “Greek base” on the Crete city of Chania;

–Handelsblatt, the German financial newspaper, named Greek prime minister Antonis Samaras as its politician of the year in Europe;

-The Italian parliament passed Mario Monti’s 2013 budget;

– Mario Monti resigned as Italy’s Prime Minister paving way for February elections;

-Spain’s parliament approved 2013 budget, cutting the deficit to 4.5% of GDP from 6.3% this year;

-Finland slashed its forecast for growth in 2013 to just 0.5% from 1.0%;

-Cyprus was downgraded by S&P Cyprus’ to junk status, two notches to CCC+.

Source: Guardian and Telegraph

Spain has made dramatic strides in cutting labour costs and reviving exports since the debt crisis erupted, turning the country into the new poster-child of Europe’s austerity regime.

Fresh data from the OECD show that Spain has narrowed the gap in “unit labour costs” with Germany by 5.5pc over the past year alone. It has clawed back 4.6pc against France and 6.6pc against Austria since late 2011, as it slashes pay and pursues a scorched-earth policy of “internal devaluation”.

(click here if charts are not observable)