Key Data Points

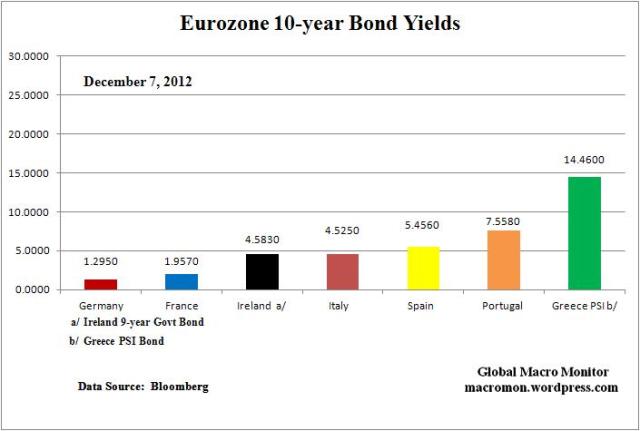

German 10-year Bund 9 bps lower;

Ireland 18 bps wider;

Italy 12 bps wider;

Spain 23 bps tighter;

Portugal 1 bp tighter;

Greece 158 bps tighter;

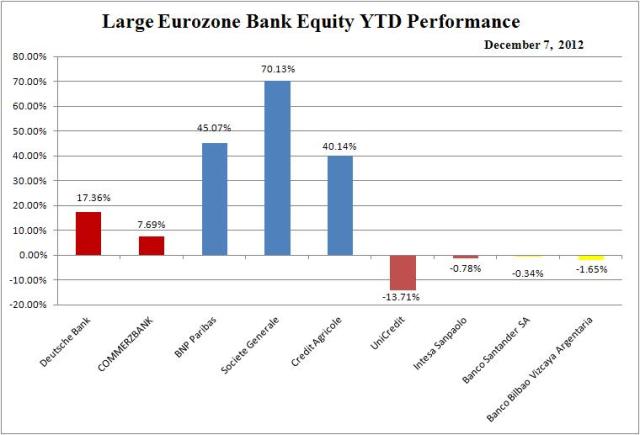

Large Eurozone banks up -1.0 to 5 percent higher;

Euro$ down 0.49 percent.

Comments

– France, Portugal, and Greece 10-year yields at lowest weekly close of the year;

– Bundesbank cut its growth forecasts for the German economy;

– Greece launches debt buyback;

– The ECB kept its interest rate at 0.75pc but looks ready to cut next month;

– Standard & Poor’s warned it could cut Italy’s BBB+ rating if the recession continues;

– Italy came under threat to dissolve its technocratic government led by Mario Monti as they lost support from Silvio Berlusconi’s PDL party.

Source: Guardian and Telegraph

The task facing Italy’s government

EVEN before Silvio Berlusconi announced that his party would withdraw support for Italy’s coalition government, the task faced by the prime minister, Mario Monti, was enormous. Mr Monti came to power after elected politicans had repeatedly failed to do anything to get Italy’s economy moving. The hope was that a technocrat with little need to placate interest groups would be able to push through difficult reforms, get the economy to grow and keep bond markets happy. This would have been hard enough were Italy an island. As it is, her neighbours and trading parners are mostly in crisis too. Mr Monti has made a start and done some unpopular things. But Italy’s overiding economic problem—a lack of competitiveness that manifests itself in low productivity growth—will take years to fix, not months.

(click here if charts are not observable)