Key Data Points

German 10-year Bund 5 bps higher;

France 1 bp wider to the Bund;

Belgium 9 bps tighter;

Ireland 9 bps tighter;

Italy 13 bps tighter;

Spain 17 bps tighter;

Portugal 12 bps tighter;

Greece 50 bps wider;

Large Eurozone banks up 5-12 percent;

Euro$ up 2.11 percent.

Comments

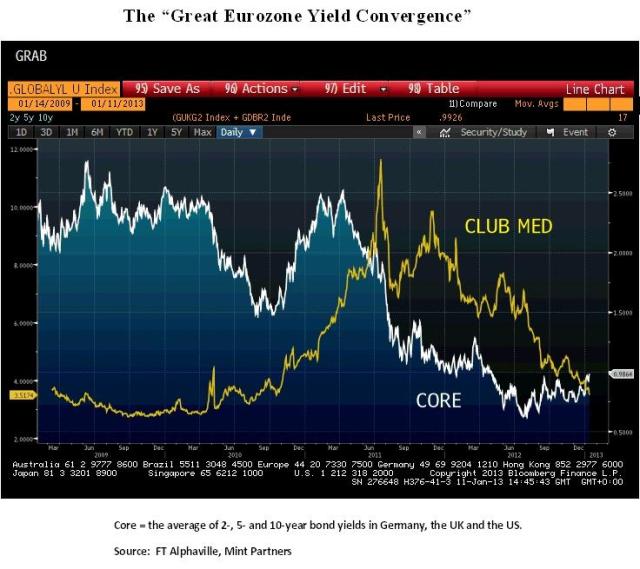

– Ireland, Italy, and Portugal bond yields fall to post-Eurozone debt crisis lows;

– Ireland sold €2.5 billion of 5-year bonds at 3.35 percent;

– Italy sold €3.5 billion 3-year bonds at 1.85 percent;

– Spain sold €5.8 billion of two-, five-, and 13-year bonds at yields of 2.587, 4.03 and 5.57 percent, respectively. The auction was strongly oversubscribed;

– The ECB left interest rates unchanged;

– Greece’s unemployment rate soared to 26.8 percent—the highest rate ever recorded in the European Union;

– Moody’s slashed Cyprus’ credit rating three notches to Caa3 as negotiations over the €17 billion aid package remains deadlocked and banking systems remains under heavy pressure.

…let’s not forget about one thing. We speak a lot about contagion when things go poorly, but I believe that there is also contagion, positive contagion, when things go well. And I think this is in play now. There is positive contagion.

– Mario Draghi, ECB President

(click here if chart is not observable)

What's been said:

Discussions found on the web: