Key Data Points

German 10-year Bund 23 bps higher;

France 8 bps tighter to the Bund;

Ireland 35 bps tighter;

Italy 46 bps tighter;

Spain 43 bps tighter;

Portugal 91 bps tighter;

Greece 88 bps wider;

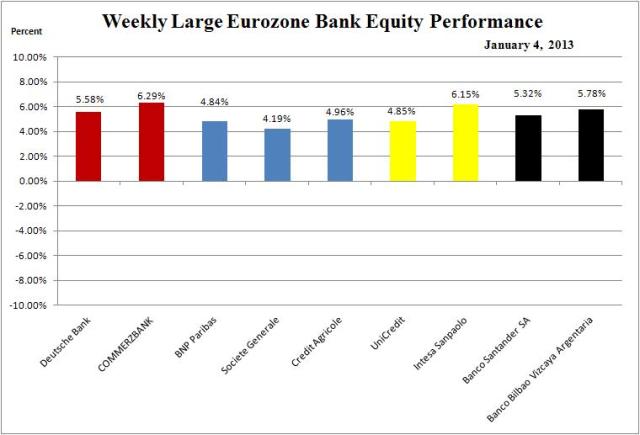

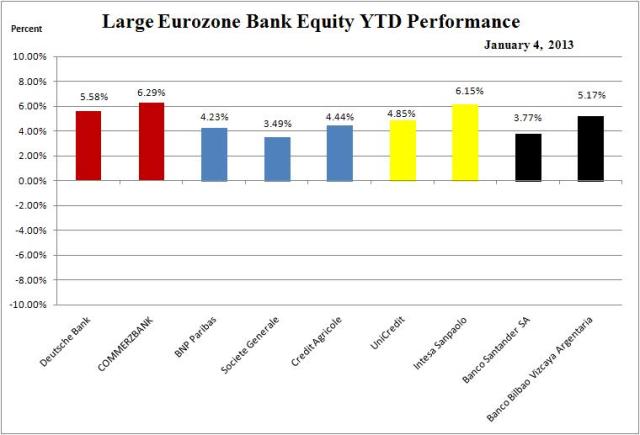

Large Eurozone banks rise 4.0 to 6.30 percent;

Euro$ down 1.08 percent.

Comments

– Sovereign spreads to the Bund continue to fall sharply;

– European unemployment increase to 20m in the second half of 2013 up from 18.7m in October according to Ernst & Young;

– France’s Constitutional Council struck down and ruled President Hollande’s 75 percent top income tax rate anti-constitutional.

An Irish recovery would provide a boost for Europe and its de facto leader, Angela Merkel, the German chancellor, as much as for Ireland and its prime minister, Enda Kenny. It would show that the controversial treatment of austerity and structural reforms imposed as the price of bail-outs can work. It would reassure the electorates of core Europe, especially German voters who go to the polls in the autumn, that rescues do not condemn them to a never-ending call upon their taxes, as seems to be the case with Greece. And a sustained return by Ireland to the bond markets would boost confidence more generally, helping other bailed-out economies such as Portugal and Spain.

(click here if charts are not observable)

(click here if charts are not observable)

What's been said:

Discussions found on the web: