My afternoon train reads:

• U.S. Stocks Fall as Fed Minutes Show Debate Over Stimulus (Bloomberg) see also Fed Officials Feared Easy Money Could Rattle Markets (WSJ)

• Seth Klarman Parts the Curtains, Carefully (Institutional Investor’s Alpha)

• A Revolving Door in Washington That Gets Less Notice (DealBook)

• Former Powell chief of staff: Bush administration cooked the books on Iraq (The Raw Story)

• WTF headline of the day: 5 dangers set to trip a 100-year bear market (MarketWatch)

• Single greatest driver of income inequality over 15 year period was runaway income from capital gains and dividends (WaPo)

• Economic Optimism vs. the Sequester (Rational Irrationality) see also GOP’s complaints about looming spending cuts ignore its role in creating them (McClatchy)

• U.S. Unveils New Strategy to Combat Hacking (WSJ)

• They’re drilling, baby, drilling – and gas prices still going up (McClatchy) see also Shale Gas Bubble Looms, Aided by Wall Street (DESMOGBLOG)

• The Recline and Fall of Western Civilization (Slate)

What are you reading?

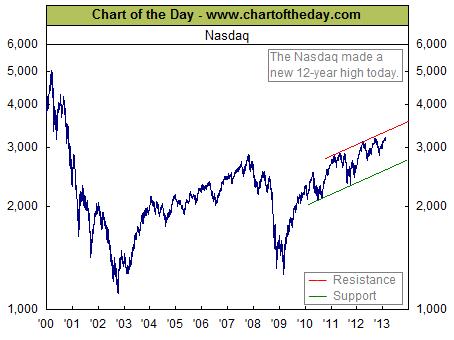

Nasdaq surpasses its credit bubble highs of late 2007

Source: Chart of the Day

What's been said:

Discussions found on the web: