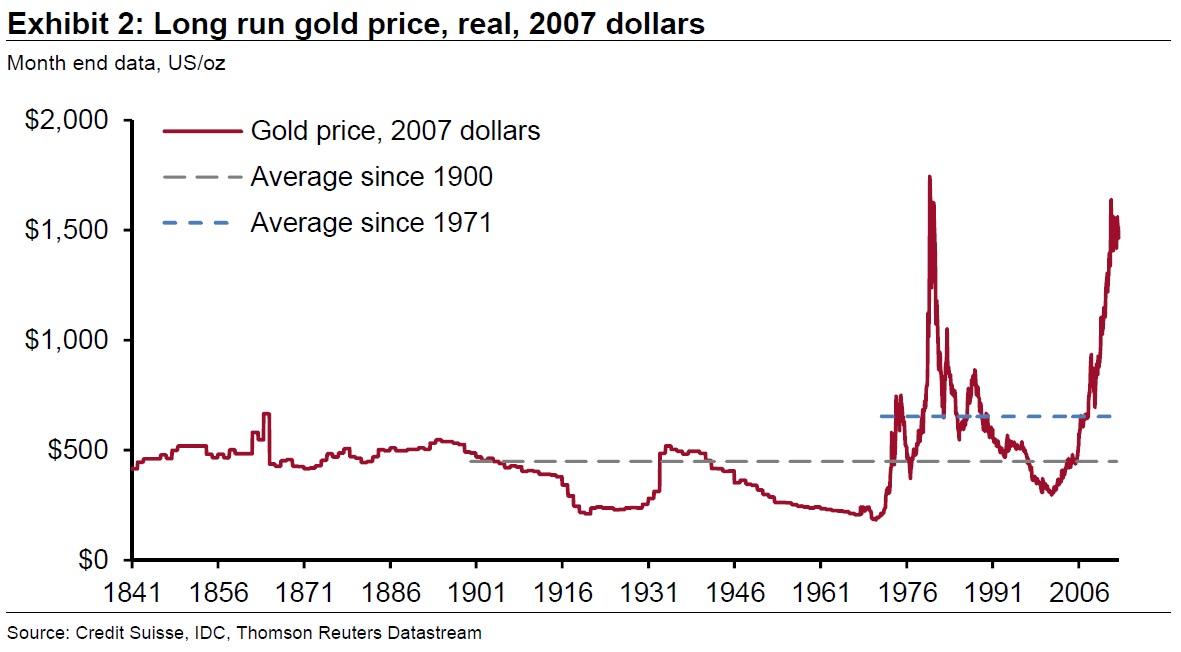

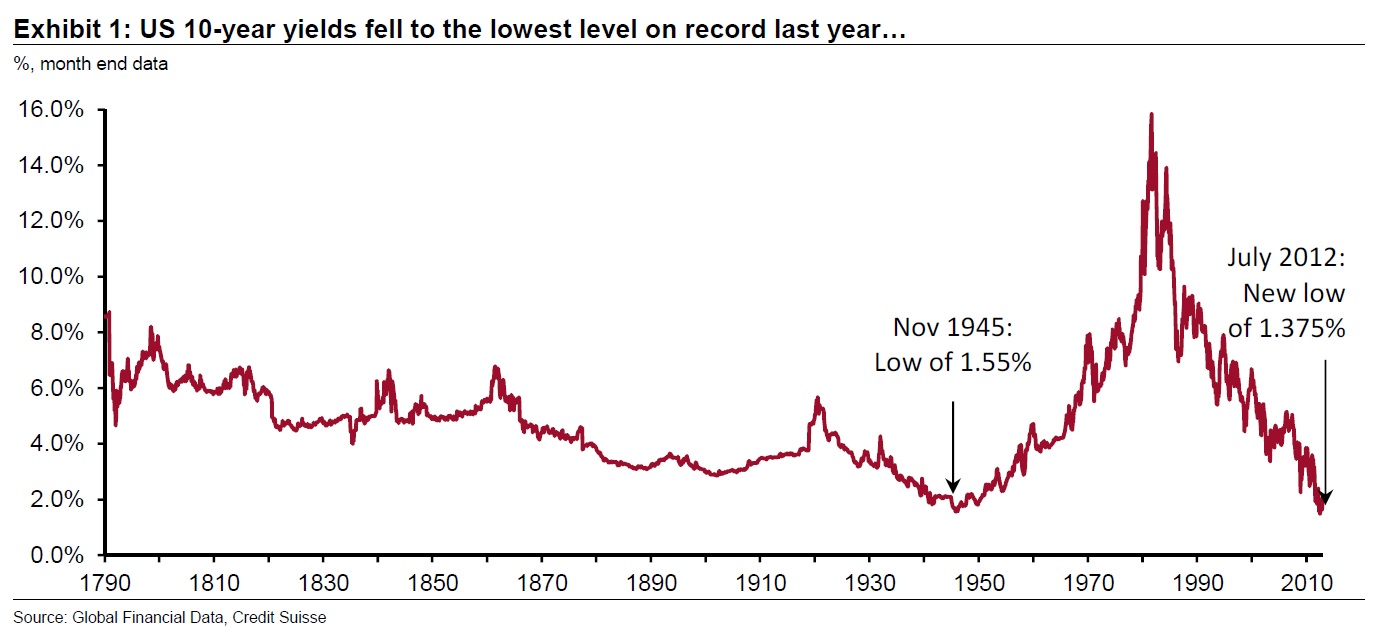

With gold back under $1600, and the 10 year at 1.87%, I wanted to show a chart of the two of them.

The correlation is not as obvious as most people think: During spikes in Inflation, Gold and Interest Rates tend to run together (see the 1970s or 2001-07).

Post crisis, the period of deflation has continued the rally in bonds that has driven rates to record lows over the past few years. But Gold has been unable to get out of its own way the past few years.

I’ll have the boys run some analytics to see exactly what this correlation looks like back to 1970s . . .

>

Source:

Gold: The Beginning of the End of an Era, February 1, 2013

Credit Suisse

What's been said:

Discussions found on the web: