“Just like a recession, they’re hard to define in real time. It’s much more obvious in retrospect . . . If you said that stocks could be up 10% or 20%, I’d say ‘sure.’ But that wouldn’t violate a more than a decade long period of chopping back and forth.”

– Ed Easterling, Crestmont Research

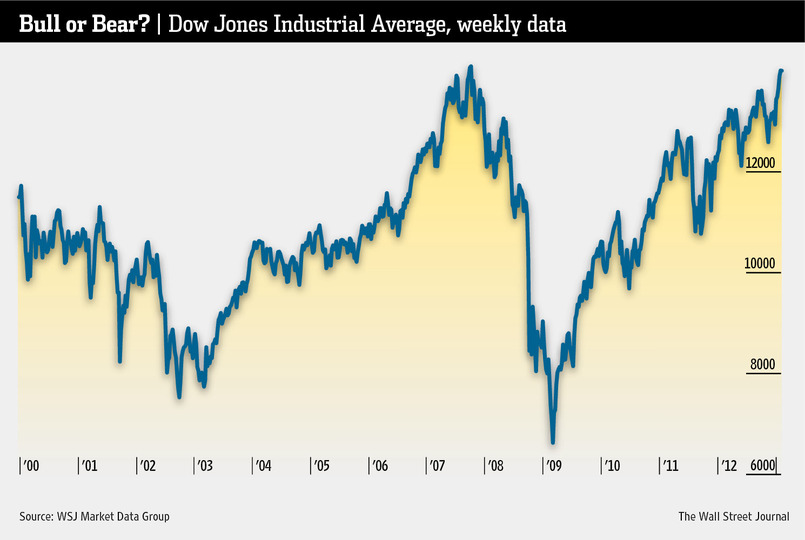

Last Monday, we looked at whether the Secular Bear Market was coming to an end? and discussed it on Bloomberg TV and Yahoo Finance. I am unsure its over, but barring a Japan like 30 year recession, we appear to be much closer to the end than the beginning.

The secular meme has spread, most recently in today’s WSJ, Is Bull Sprint Becoming a Marathon?:

“the rally at the beginning of this year—and signs that investors are putting more money into stocks—has fueled a debate about whether that extended bear market may be over. That would signal the dawn of a secular bull market, priming investors for years, and possibly decades, of double-digit gains.

There is no single marker for the start or end of a secular trend, a fact that has contributed to the debate over whether there has been a secular turn in stocks.

That differs from shorter-term, or cyclical, bull and bear markets, which are broadly defined by gains or losses of 20% from a recent low or high. And because the secular-market trends can last for well over a decade, there are relatively few to study.”

As previously discussed, the caveat to this is the FOMC wildcard. QE and ZIRP make it difficult to think of most gains as completely organic. It also has made any comparisons to prior secular bull markets more challenging, as it introduces another variable.

Under ordinary end of secular bear market conditions, I would like to see P/E ratios even lower and stocks even more hated/ignored. The Fed has disrupted those metrics and that makes seeing the end of the secular bear all the more challenging.

The price weighted Dow at all time highs is the wrong index — look at S&P500

Source: WSJ

Source:

Is Bull Sprint Becoming a Marathon?

TOM LAURICELLA

WSJ, ABREAST OF THE MARKET February 11, 2013

http://online.wsj.com/article/SB10001424127887323511804578295963909525322.html

What's been said:

Discussions found on the web: