Source: Spiegel

On Monday, our AM readings had a link to Krugman’s Hot Money Blues. There was lots of pushback against the article, which blames concentration of capital seeking to circumvent taxes and regulation as an underlying cause of nearly all financial crises:

“But the truth, hard as it may be for ideologues to accept, is that unrestricted movement of capital is looking more and more like a failed experiment . . . Since 1980, however, the roster has been impressive: Mexico, Brazil, Argentina and Chile in 1982. Sweden and Finland in 1991. Mexico again in 1995. Thailand, Malaysia, Indonesia and Korea in 1998. Argentina again in 2002. And, of course, the more recent run of disasters: Iceland, Ireland, Greece, Portugal, Spain, Italy, Cyprus.

What’s the common theme in these episodes? Runaway bankers; they played a role in a number of these crises, from Chile to Sweden to Cyprus. Best predictor of crisis is large inflows of foreign money: in all but a couple of the cases I just mentioned, the foundation for crisis was laid by a rush of foreign investors into a country, followed by a sudden rush out.” (edited & emphasis added).

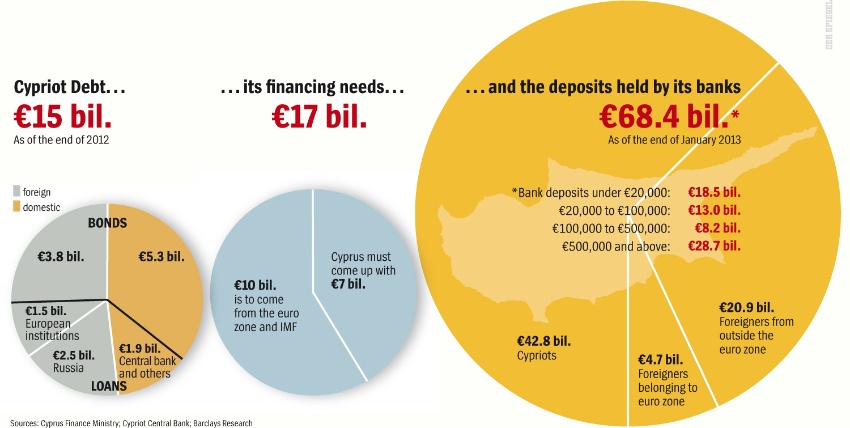

Perhaps a better way to express that is a visual depiction of Cyprus’ Debt and Bank deposits, shown above. The outsize deposits relative to the nations debt or GDP) does seem like an accident waiting to happen.

There are other tax havens — Luxembourg, Switzerland, Cayman Islands, Bermuda, Singapore, Dubai, etc. — that have yet to have their crisis. This implies a full on financial crisis requires more than mere concentration of idle tax-avoiding capital. Something else must be the trigger.

Source:

Bailout Insights: What Cyprus Tells Us about Germany’s Character

Tyson Barker

Spiegel, March 26, 2013

http://www.spiegel.de/international/europe/the-cyprus-bailout-reveals-german-fears-of-tax-havens-a-891063.html

What's been said:

Discussions found on the web: