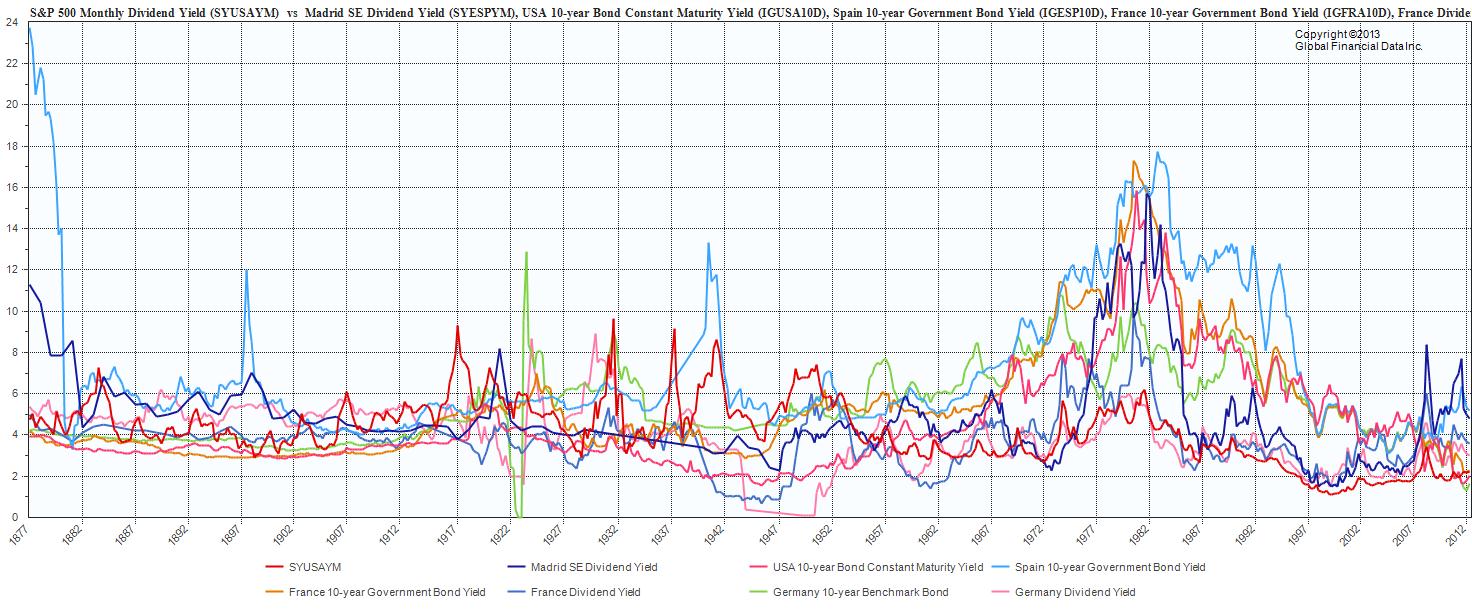

Equity Index Dividend Yield vs 10 yr Bond to 1877

With nearly every major developed country in the world and their central banks — FOMC, ECB, BOE BOJ, etc. — have driven their interest rates to zero, investors are hunting for yield. (Maybe someone can securitize risky mortgages or sumpthin’). Really interesting long term chart looking at the plight of investors hunting for yield.

The chart above looks at the US, France, Germany and Spain and their respective Equity Index Dividend Yield vs 10 yr Bond to 1877.

Note there are times when these countries go their own separate ways — what’s up with Spain? — but when global events hit like inflation in the late 1970s, they react similarly.

Source:

Ralph M Dillon

rdillon@globalfinancialdata.com

www.globalfinancialdata.com

What's been said:

Discussions found on the web: