Cyprus, according to the CIA factbook, is a former British colony with a population of 1,138,071 people, 77% of whom are Greek.

The tiny island nation rarely moves markets, but is at the center of today’s weakness, as fears that Cyprus could kick off of the next European crisis.

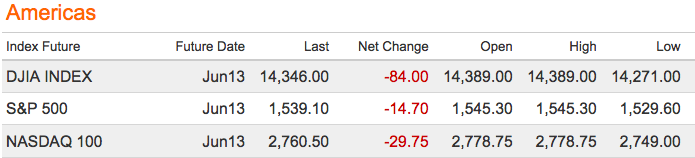

The Euro fell 1.1%, as the dollar rallied as monies poured into US Treasuries as a safe haven. European stocks slid on contagion fears. In Asia, markets were significant pressure. MSCI Asia Pacific Index (MXAP) sank 2%; Japan’s Nikkei 225 dropped 2.7% (biggest decline in 10 months). Even Australia’s S&P/ASX 200 Index got hit for 2.1%.

Gold advanced past $1600 for the first time in 2 weeks.

How significant is the Cyprus story to markets? Over the long haul, probably not much, but as of 5am this morning, the first 6 most popular stories on Bloomberg.com are all Cyprus related.

Most Popular Stories

-

The euro weakened to its lowest level this year, while stocks and commodities slumped, as an unprecedented levy on Cyprus’s bank savings threatened to throw Europe back into crisis. German two-year note yields dropped below zero as Spanish and Italian yields surged.

-

Asian stocks headed for the biggest decline in eight months, led by raw-material producers, amid concern an unprecedented levy on bank deposits in Cyprus will plunge Europe back into crisis and that China will increase efforts to curb property prices.

-

The euro fell the most in 14 months against the dollar after an unprecedented levy on bank deposits in Cyprus threatened to throw Europe back into crisis.

-

Gold rose above $1,600 an ounce for the first time this month, widening its premium over platinum, as an unprecedented levy on Cyprus bank deposits reignited concern over Europe’s debt crisis and boosted haven demand.

-

Europe braced for renewed turmoil as outrage in Cyprus over an unprecedented levy on bank deposits threatened to derail the nation’s bailout. European shares and the euro tumbled.

-

Treasuries gained for a second day as an unprecedented levy on bank deposits in Cyprus threatened to reignite the euro region’s debt crisis, boosting demand for the safest assets.

What's been said:

Discussions found on the web: