Click to enlarge

Source: USA Today

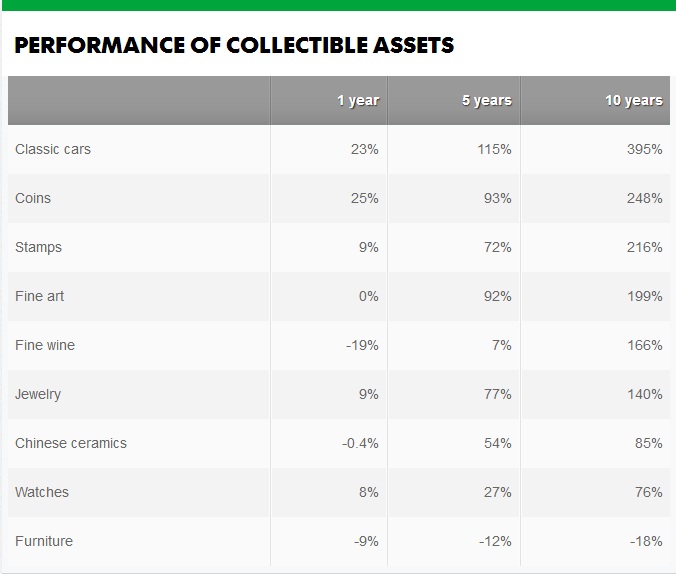

According Knight Frank’s Wealth Report, an index of the nine main collectibles markets grew 175% over the 10 years ended in the third quarter 2012 – a far better record than U.S. stocks, whose Standard & Poor’s 500 index is up only about 40% for that period:

• Classic cars were the top-performing collectible; Car prices surged 23% the 12 months ended in the third quarter of 2012, the report said; they racked up gains of 11% over five years and 395% over 10 years.

• The number two collectible: coins with 25% — and 248% gains over 10 year.

• Stamps came in a close third, with nine 9% gains last year and 216% over 10 years.

Understand that most of these investments are non liquid, have costs that are associated with ownership, require an expertise to make investments.

What's been said:

Discussions found on the web: