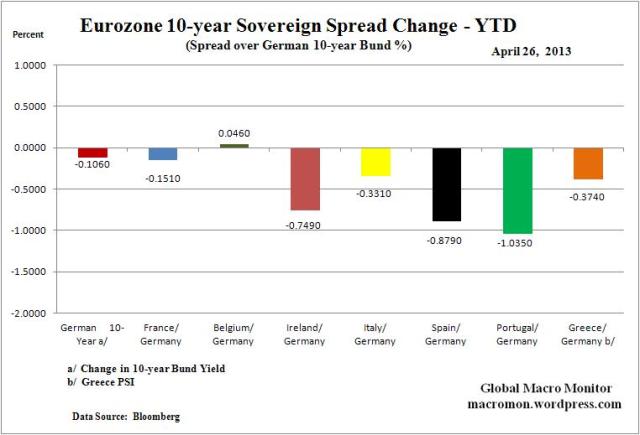

Key Data Points

German 10-year Bund 4 bps lower;

France 1 bp tighter to the Bund;

Belgium no spread change;

Ireland 6 bps tighter;

Italy 12 bps tighter;

Spain 30 bps tighter;

Portugal 15 bps tighter;

Greece 4 bps tighter;

Large Eurozone banks weekly change, -10.60. to 10.42 percent;

Euro$ down 0.41 percent.

Comments

- The German Bund is approaching its 1.127 percent low made last July;

- Italy, Spain, and Ireland yields at lowest post-crisis weekly close;

- The Bundesbank criticised the ECB’s bond-buying programme designed to save the euro, questioning whether it is really necessary and suggesting it represents a great risk to taxpayers. – FT

- Italy sold €8bn of six month treasury bills at a yield of 0.503%, down from 0.831% previously andthe lowest rate since the introduction of the euro. – Nick Fletcher, Guardian

- Pimco, the world’s biggest bond fund has been cutting its holdings of Italian and Spanish government debt after their recent rallies. – Grame Wearden, Guardian

- Enrico Letta has been handed the mandate to form Italy’s next government by president Giorgio Napolitano. – Grame Wearden, Guardian

- Enrico Letta told reporters in Rome on Wednesday that his top priority was to tackle the “enormous, unbearable” economic emergency in Italy, in a signal that his government could change the pace of austerity. – Grame Wearden, Guardian

- French unemployment rising by 1.2% to 3.225m, the 23rd monthly rise in a row worst level since records began in January 1996. – Grame Wearden, Guardian

- Spain‘s joblessness has reached fresh heights over the first three months of the year with a record 27% of the workforce unemployed. – Giles Tremlett, Guardian

**********************************************************************************

Italy’s Letta enters political twister

It is a very difficult situation, fragile, unprecedented.- Enrico Letta

**********************************************************************************