The chart above comes from a piece penned by Bob Ivry, who explored the unfair advantages of the TBTF banks.

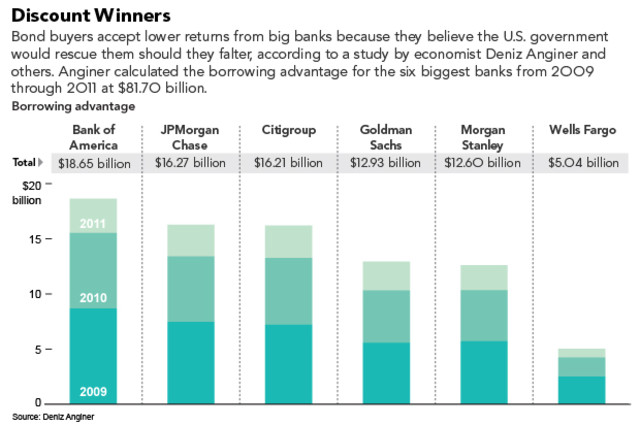

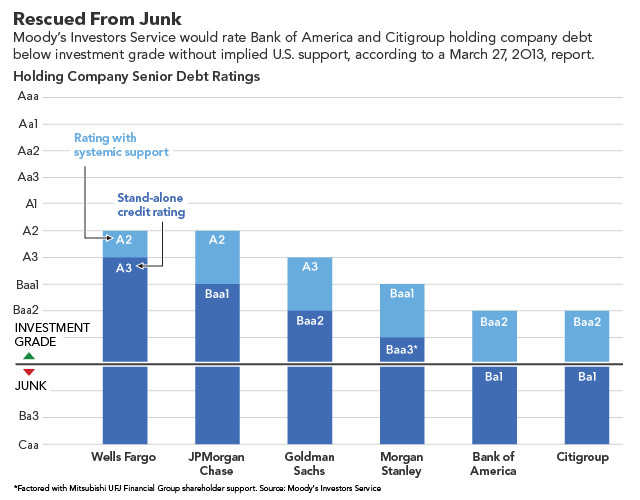

Note the chart shows how the ratings agencies would change their views — and credit ratings — of TBTF banks without the implicit promise of a bailout when any of these banks screw up. Another chart after the jump shows how bond buyers accept lower returns from TBTF banks given the governments implicit guarantees.

Ivry wrties:

“These six banks — Bank of America Corp. (BAC), Citigroup Inc. (C), Goldman Sachs Group Inc., (GS) JPMorgan Chase & Co. (JPM), Morgan Stanley (MS) and Wells Fargo & Co (WFC). — have also benefited from tax breaks and Federal Reserve largesse since the end of 2008 in the form of additional income from the central bank’s mortgage-bond purchases and the interest it pays for bank deposits.

All told, the financial advantages for the six biggest banks since the start of 2009 amounted to at least $102 billion, according to data compiled by Bloomberg.”

Its Socialism for the banks, Capitalism for the rest of us . . .

Source:

No Lehman Moments as Biggest Banks Deemed Too Big to Fail

Bob Ivry

Bloomberg Markets Magazine, May 10, 2013

http://www.bloomberg.com/news/2013-05-10/no-lehman-moments-as-biggest-banks-deemed-too-big-to-fail.html

Source: Bloomberg Markets Magazine

What's been said:

Discussions found on the web: