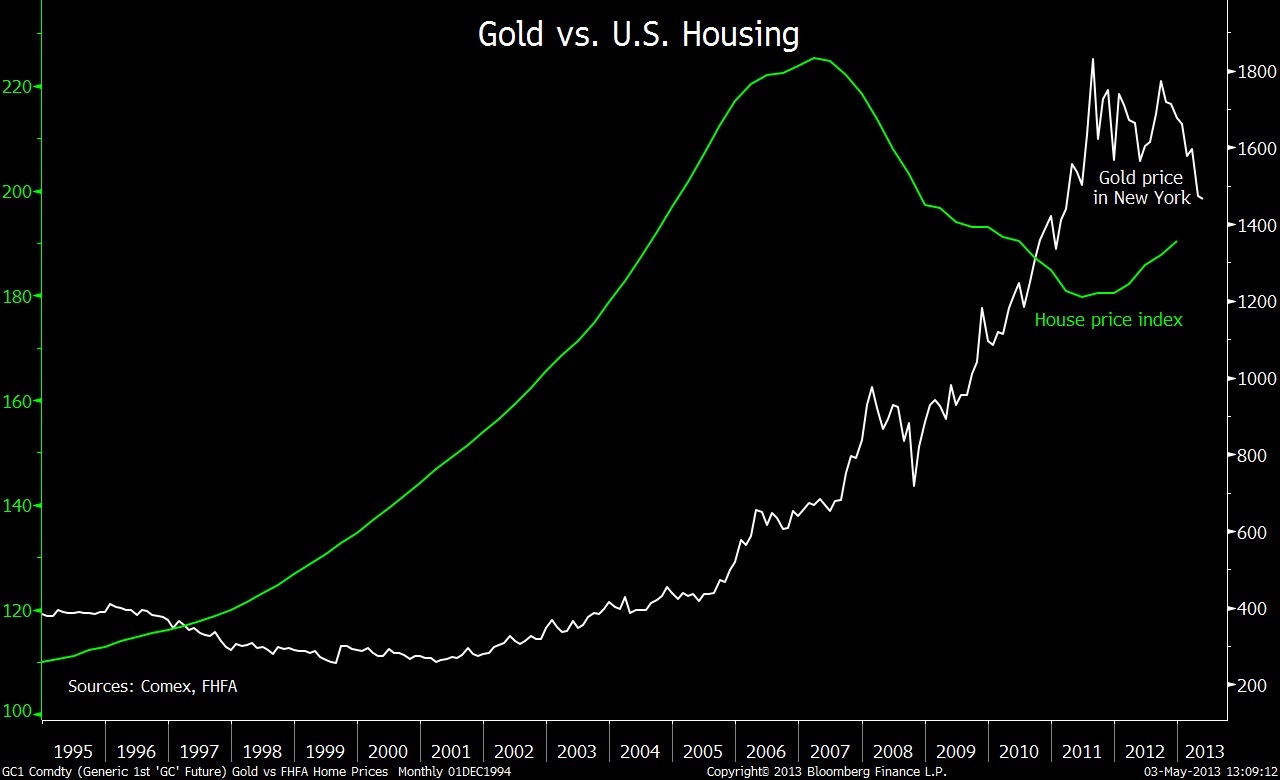

Source: Bloomberg’s Chart of the Day, Federal Housing Finance Agency

Here is something I never would have guessed at, via Dave Wilson of Bloomberg: If you want to be hedged against the risk of a pickup in inflation, you would be better off buying houses than gold.

That’s according to Michael Hartnett, chief investment strategist at Merrill Lynch. His chart (above) shows the U.S. house-price index and the price of Gold since 1995.

According to Bloomberg, “Home prices rose 6% through the end of last year from their low in the second quarter of 2011. Q1 reading is due May 23. Prices in 20 of the largest U.S. cities increased 0.4 percent through the first two months of this year, according to the Standard & Poor’s/Case-Shiller index.”

As houses became more expensive, gold got cheaper. Its off as much as 31% from its September 2011 peak of $1,923.70 an ounce.

Source:

Houses Surpass Gold for Hedging U.S. Inflation

David Wilson

Bloomberg May 3 2013

What's been said:

Discussions found on the web: