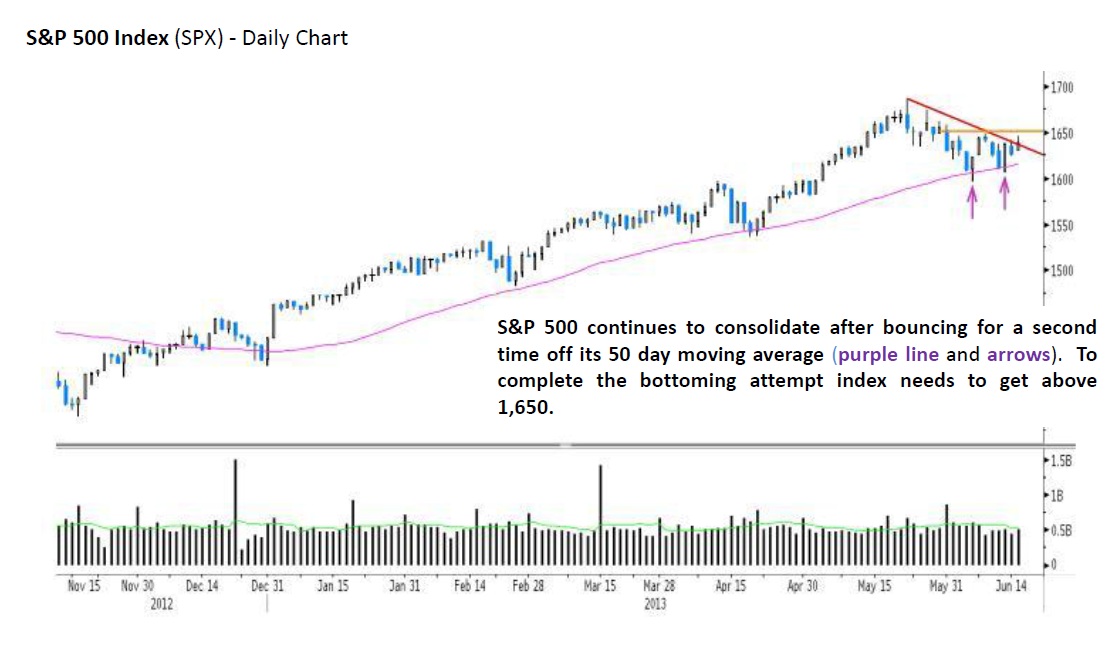

Major U.S. indices such as the S&P 500 and the NASDAQ Composite have both recently stabilized and bounced for the second time off their respective 50 day moving averages. Though historically June tends to be a negative month for stocks, with only 9 trading days left in the quarter we wonder aloud whether quarter ending “window dressing” will keep stocks elevated until June passes.

Market internals have certainly shown some deterioration of late, however, the old adage is to respect the trend and the trend still remains up as long as the recent lows, near the respective 50 day moving averages, hold.

Please see attached note for chart on the S&P 500 and NASDAQ Composite.

What's been said:

Discussions found on the web: