Good Monday morning: The lovely weekend weather has been replaced with hot humid & steamy Summer heat.

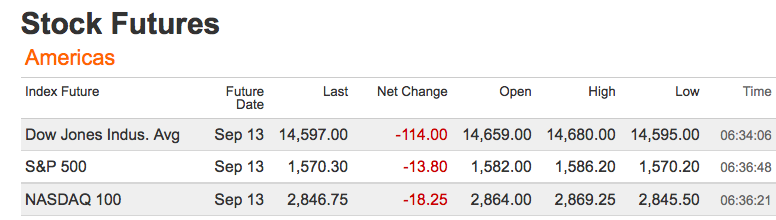

The markets are also skipping the pleasantries and rushing headlong into the a summer melt down. No cavalry came to the rescue after last weeks minor carnage. Hence, the summer swoon begins pretty much on time, where prior swoons began.

What is somewhat different this go round is the unlikely market rescue by the Fed. Unlike prior interventions, QE4 is open-ended and continuous. Hence, we will not likely see a grand announcement about a new plan which will excite traders. Instead, we are most likely to hear minor notes and course correction discussions as various Fed agents discuss and debate policy in public. We may also hear more often from the Fed’s chosen conduit to the Street, Jon Hilsenrath.

Understand that the reaction to the inevitable tapering of QE will be neither rational nor timely, but rather the typical emotion driven trading that makes up most of the daily noise. We can also expect an outsize reaction — or overreaction — as potential replacements for current FOMC chair Ben Bernanke get floated in various trial balloons.

I am less convinced that we actually know what is driving these markets than most of us believe. QE Tapering, lots 0f earnings pre-announcements, China’s credit crisis, even just a market that has run too far too fast are all equally valid explanations. Some combination or perhaps none of the above are also just as valid explanations as why the rationales are likely right or wrong.

Regardless of who the next Fed Chair is, they will confront the same issues as the current chairman: A post credit-crisis economic recovery which is softer than we prefer, marked by weak GDP gains and mediocre job creation. They will face a huge balance sheet that will require 7 or so years to run off its excess holdings, a financial sector that still has too much bad paper on its books but a huge appetite for leverage and risk, which helped to create a market that has run up 146% despite an investing public that is completely disinterested.

Despite excellent benefits, you have to wonder who really wants this job.

~~~

More to come later

What's been said:

Discussions found on the web: