Missing the Target

Source: WSJ

You may have missed the WSJ’s takedown on Target-date funds this weekend. Its a must.

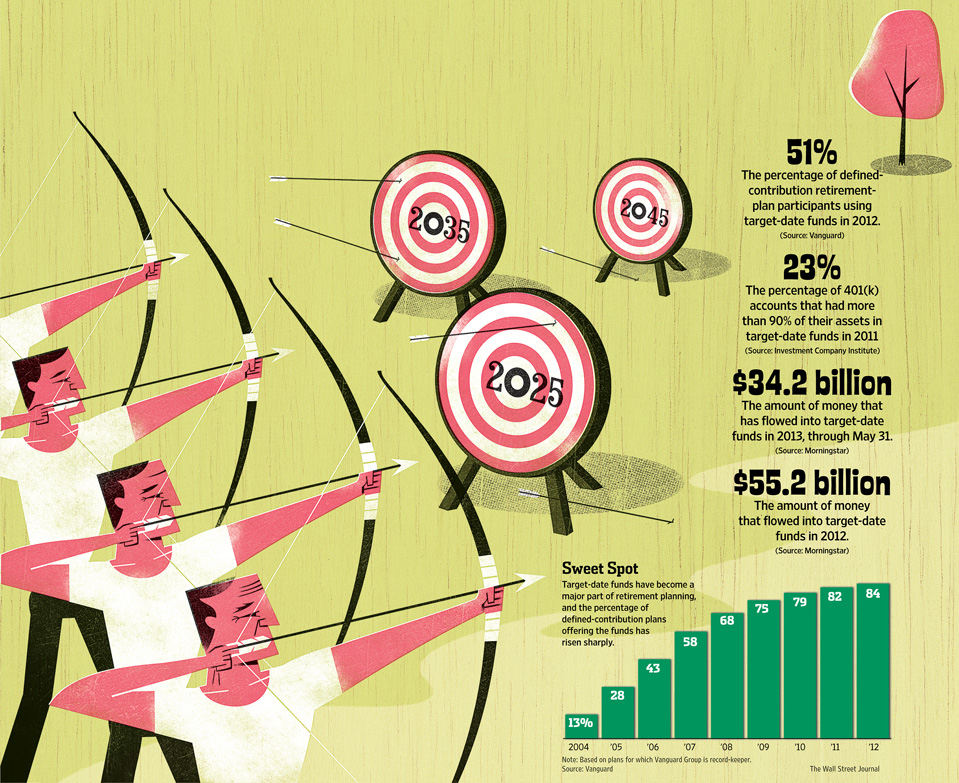

The idea of target date funds are a form of auto-pilot that automatically shifts allocations into more bonds less stocks as the investor ages. Target date funds now manage about $550 billion dollars.

The problem with these funds — aside from high fees and higher-costs — is how out of phase its been with the markets for retiring babyboomers. Many of them have found they are selling equities into weakness and buying bonds into a 30 year bull market which is looking kinda old and shaky.

Anyone with a 401k or who uses these funds should definitely give the article a read.

Source:

Missing the Target

LIAM PLEVEN and JOE LIGHT

WSJ, June 14, 2013

http://online.wsj.com/article/SB10001424127887324049504578541831083543670.html

What's been said:

Discussions found on the web: