My morning reads:

• Finance set to surpass tech as most-profitable U.S. industry (USA Today)

• China Wealth Eludes Foreigners as Stocks Earn 1% in 20 Years (Bloomberg)

• Why It’s Time to Pay Attention to Europe Again (iShares)

• If the US economic recovery keeps its present pace, goldbugs and miners can expect bad news (Telegraph) see also Unbelievable investor letters like this are why people think gold bugs are stupid (Behavioral Macro)

• The Big Backlash against hedge funds (The Reformed Broker)

• Time To Move On From the Taper Tantrums (Tim Duy’s Fed Watch) see also Bernanke Boom Signaled by Yield Surge as Market Recalculates (Bloomberg)

• Its not just the USA: Ailing Infrastructure: Scrimping Threatens Germany’s Future (Spiegel) see also Rising interest rates could mean the window to fix infrastructure on the cheap is closing (Washington Post)

• To Rescue Local Economies, Cities Seize Underwater Mortgages Through Eminent Domain (The Nation)

• Disruptions: Hollywood, or Silicon Valley: Where’s the Money? (Bits)

• The PC Market Isn’t Dead Yet, but It’s Barely Breathing (Barron’s)

What are you reading?

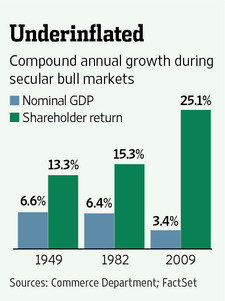

Tame Inflation Also Has Some Drawbacks

Source: WSJ

What's been said:

Discussions found on the web: