July 2013

Value is the Thing

Take a big risk to grow and add jobs

Manufacture disks to rid corn of their cobs

Kernels for bisques and gluttonous hogs

The idea can’t miss, wealth by the gobs

But o’er in a land far, far away

A small little brand and a sweaty array

Of cheap, hungry hands foregoing all play

Producing cob corers for two bucks a day

Sales soon drop as waist belts get big

Canned bisque is a flop, up is the jig

Now only needed as slop for the pigs

Production to stop? (Unlikely, you dig?)

The factory is “fair” cause workers stay sated

With bennies and shares and grandeur now dated

Bosses need only keep shareholders elated

By showing great flair at new highs unabated

Cobber Inc. shares rise year after year

Through buybacks contrived to make them more dear

Debt long-lived to some distant year

Funds the whole lie that production is here

And so it goes…

The economy grows, see NGDP

Though everyone knows the growth isn’t free

Real growth may be slow but don’t disagree

Continue the pose (even when negative, see?)

Growth’s only good when capital’s built

Debt’s dead wood when it’s done to the hilt

Look under the hood and under the kilt

Real value has stood when growth starts to tilt

Only three ways to mend leverage amok

Formally suspend all debt owed in bucks

Or let debt end on its own (that sucks)

Or simply rend new money in trucks

Simple and significant in drink and clear thought

Forget what they think and what you were taught

Price metrics stink when they’re commonly sought

Real value’s the thing, half sold is well-bought

Beta Blockers

Those who believe in the random walk theory suspect there is no point in trying to outthink the market. Efficient market theorists raised this notion to new heights, using elaborate calculations to show that even though one in a thousand monkeys would be able to pick the next ten-bagger, there would be no causality. Both see markets as fairly efficient pricing mechanisms because market participants have more or less the same amount of relevant information on which they may invest rationally.

In our view, public markets are incredibly inefficient when it comes to accurately pricing risk-adjusted value because they are, by their very nature, organisms that reward or punish assets based on the aggregate of investors’ lowest common investment objectives over the shortest of investment horizons.

The argument that only fools try to outthink the market rationalizes index (i.e., “social”) investing. Social investing makes investing seem more like saving. When most investors remain fully invested, perpetually dedicating the great majority of their capital to the markets regardless of underlying valuations or risks, it follows that market pricing is determined by non-cognitive speculators. So, while it may be true that markets are always right at each point in time, they usually do not reflect sustainable risk-adjusted real value. How else might one explain negative real interest rates or Pet.com?

The weak link in the whole chain is not the inability of experienced people to recognize true value, but the institutionalized idiocy of beta investors exercising their mandated fiduciary duties. Ultimately their portfolios may be treated like lambs to slaughter but it will occur with most everyone else and seem like a natural disaster no one could have foreseen. In the interim, they appear to be prudent and responsible. As the logic goes, if one is hugging an index (overtly or closeted), he or she is taking no risk. The market’s overall real valuation – rich or cheap, no matter – plays no part in decision making.

Fat Tails, easily definable events we know will occur but not when they will occur, are not Black Swans, Nassim Taleb’s metaphor for unforeseeable exogenous shocks. We think the fools are those taking great risk in the markets by ignoring both, the ones mistaking speculation for saving. The default objective for savers should not be degree of market participation, but rather purchasing power maintenance. The default objective for investors should be purchasing power enhancement (i.e., positive real returns).

The truly adult approach to capital markets should be the quest for risk-adjusted Alpha, in our view, and the most reliable strategy to find it consistently is through real value investing. Indeed, markets price assets nominally for all known information today; yet they do so for tomorrow. They are unconcerned with risk-adjusted real value or the day after tomorrow, and that is the opportunity for those who think.

A Simple Investment Thesis

For stock investors, investing in a good business at a good price has always been the most reliable means of generating risk-adjusted excess returns over time, and yet in the current environment earning risk-adjusted Alpha through value investing would be incomplete without fully appreciating the impact of macroeconomic inputs. Is it really different this time or have the best investors always chosen businesses by having a thorough understanding of their relative importance within the context of macro inputs, such as inflation expectations, policy interventions, fluctuating currencies and trade agreements?

Capital allocated to good businesses bought right is great. Capital allocated to good businesses bought right consistent with supporting macro trends is oftentimes better. Capital allocated to good businesses bought right in anticipation of reversals in macro trends can be best – in fact, phenomenal.

Our sense of sustainable value in today’s global markets is tied directly to the general perception of future inflation. The overwhelming majority of investment capital is positioned for low inflation today and tomorrow. This implies and explains the current dominance of levered revenue models sponsored by levered investors borrowing from levered creditors. Were expectations of rising inflation to come to the fore, we believe un-levered assets and businesses that do not rely on ever-more public leveraging would perform far, far better than currently levered assets owned by levered investors selling goods and services to businesses and consumers that fund their purchases through credit.

Since very few investors expect rising inflation anytime soon, the return skew is overwhelmingly positive in its favor. Both deep value and gamma are buried in the changing popular perception of future inflation, and the best part about this is that rising price inflation expectations are precisely what all central banks around the world will soon be forced to promote. Don’t fight the Fed – front-run it.

Macroplasty

Macro trends impact global, regional, sector and entity-specific revenues, costs, earnings by impacting the magnitude of supply and demand for specific goods and services. They also drive the relative value of currencies in which assets are denominated. As we have seen so often, rotating central bank currency devaluations signal predictable corporate strength in certain domiciles and industries over others.

Macro considerations need not be abstract. Would Wal-Mart have a viable business model without low-cost foreign production? What would GE’s enterprise value be without GE Credit and an accommodative Fed? Would the business flowing through Goldman Sachs be nearly as robust were it not for the Fed’s reliably accommodative monetary policies? Would weakening JPM earnings make steepening yield curves more predictable? Would health care costs (and revenues) in the US have risen at the same torrid clip were Americans not getting older, or if insurance premiums were not ultimately subsidized through ever-increasing government deficit spending that funds Medicare and Medicaid? Will Apple shareholders benefit more over time than the providers of credit for consumers buying its products?

Macro may be the new black, and for exceedingly good reasons, but it seems very few are profiting directly from it today. Is that because most are dull or ill-informed, lazy or not in touch with good information? We don’t think so. More likely it is because our currencies are moving targets, and therefore the secular value of everything cannot be accurately judged. Macroeconomics cannot be reasonably explained or anticipated today, and, as a result, macro-market cross-rates and relative values cannot be quantified. If we may, macroeconomics has been reduced by world-improving monetary authorities to the study of gibberish. The folly (“I’m tapering, just kidding, I’m tapering, just kidding”) would be funny if it were not so real and contemporary and meaningful.

The entire spectacle is manifest in the public capital markets where almost no new capital is being formed, or (and here’s the weird part), where little sustainable wealth is being created and transferred. Our time is defined by economic releases suggesting little and unreserved electronic credits hop-scotching back and forth in search of financial return. Bernanke or Draghi, Ackman or Icahn, place your bets. (Hey, I love this guy cause I make money betting against him!) Where’s the value proposition?

As humbled investors longing to be falsely modest, we need not be bitter by the markets’ de-emphasis on real value or on the value of experience (or even on the evanescence of the Dollar Empire). We shall apply ourselves further and stay the course, just in case everyone acknowledges once again that the sun rises in the east and markets are for capital formation and pricing. To find real value today we take a fresh look at economic fundamentals and the implied commercial fundamentals beholden to them.

Everything has a Price

Two hundred years before Smith and Hume, longer still before Ricardo, and almost half a millennium before Keynes and Friedman, Nicolaus Copernicus (while he was not redefining the solar system by putting the sun at its center) first put forth the Quantity Theory of Money. Good stuff, that. It is an immutable truth that the change in the supply of money directly impacts prices. More money chasing constant value must increase nominal prices.

It begins to get squirrelly when observers mistake credit for money and desire for aggregate demand. In fact, desire – not demand – for goods, services and everything wonderful may be infinite but prices cannot rise without the means to satisfy that desire. Desire plus money (and credit) equals demand that economists may then quantify. Thus, the quantity of money drives the general price level regardless of needs and wants, regardless of human incentives, or regardless of economic theories and policies that suspend or misdirect its popular understanding.

The common rejoinder “what about monetary velocity?!” is pig in a poke, in our view, where and when it counts. Yes, nominal price levels may rise or fall when more or less money (or credit) is exchanged in the economy. But nominal price levels ultimately mean little. Why? Because in non-barter societies the only thing that truly matters to users of money is value, not price. The inherent value of a good, service or asset does not change with its price, which may fluctuate wildly with the money stock and/or velocity.

The most critical determinant of a well-functioning and sustainable economy, no matter how large or provincial, is the spread separating nominal wage and price levels from their ongoing value to society. Strong economies are those where clearing prices reflect well the sustainable social value of labor, goods, services and assets. Weak economies are those where the general price level is more abstract.

Economic viability is ultimately defined by how many of us produce something of value. Production – not demand – is where economies start because without production members of society do not have the means to fulfill their desires, unless they borrow it from those that have produced. (The temporary bridge is credit, which we discuss below.) Without production there can be no lasting supply of goods and services, no stable pricing, no sustainable money, and no economy. Thus, the means of production ultimately define and price real value and determine the scale and nature of economic activity.

The nominal price of everything from labor to crude oil to shipping lanes, from iPhones to AAPL shares, is derivative of their values to society. Fiscal policy makers trying to tweak where money flows, and monetary agents trying to tweak nominal price levels by fiddling with the quantity of money and credit, are also beholden to the means of production. Monetary policies seeking to change or stabilize prices in order to manage temporal human incentives mean little when societies are not producing.

Copernicus’ insight almost 500 years ago would no doubt lead him to believe today that while the money stock and general price level are indeed linked, the center of a viable economy – the economic sun, if you will – is not price but the value generated from sustainable production.

Top Down for the Bottom Up

Most economists and investors believe unpredictable animal spirits influence overall demand for goods and services, and from these mysterious sociological oscillations economic and business cycles emerge.

Bah. For centuries, with varying degrees of intensity, governments and banking systems have had incentive to leverage our economies – governments through deficit spending so politicians could exert their will without coincident consequence, and banks through fractionally reserved lending so they could produce near-term profits. Ultimately, governments, banking systems and, as a result, the means of production, become less able to service the consequent systemic debt created by all the credit, and so our economies are naturally, reflexively, compelled to de-lever (and so too are banking systems).

Most believe the process of de-levering must take the form of nominal debt destruction (i.e., Detroit?). It can, but does not have to, especially when central banks are involved. The need to de-lever arises from the increasing burden of servicing liabilities and the attendant growing disincentives to grow liabilities further. During these times real output tends to slow and can turn negative. When this occurs, those in charge of money and credit tend to manufacture more of it, leveraging the system further and increasing the burden of repayment. (A loan created today also creates an offsetting deposit in a quantity able only to retire the principal of amount of the loan, not the interest burden it bears. Hence, new loans/deposits must be created today to service the interest burden of the loan created yesterday.)

Ultimately, necessary de-levering usually comes in the form of currency devaluation against a more stable one, or against a scarcer monetary metal. There need not be economic contraction or savings loss in nominal terms, or even nominal price declines of goods, services and assets. In real (inflation-adjusted) terms, however, there does have to be economic contraction, as well as savings and investment losses. (There is also a transfer of relative wealth between savers and debtors. Nominal inflation or deflation determines the direction that wealth transfer flows.)

Today’s apparently a-cyclical economies make it crystal clear that the leverage cycle is the ultimate determinant of demand for goods, services and labor – not animal spirits. To be more specific, the fluctuating ratios of 1) credit-to-base money in the banking system, and its evil twin, 2) public debt-to-assets in the broader economy, literally determine secular economic and business cycles. (Debt to GDP ratios are fine but they compare the stock of debt to the flow of output. One cannot service or repay a dollar-denominated debt with an iPhone. Money is needed.) We argue that consistently easy credit conditions have led to ever-increasing consumption of goods, services and assets, which in turn have levitated output and prices to levels unsupportable by production.

Credit comes in two forms: 1) collateralized credit/secured debt into which any two counterparties may enter, and 2) unreserved credit that may only be created in a fractionally reserved banking system. The great majority of economists across the political spectrum seem to conflate the two and under-appreciate the lasting impact on economies of the latter, unreserved credit.

If unreserved bank credit is not extinguished, only continually rolled over, it eventually pressures banks and their central banks to inflate nominal asset prices on which that credit was extended (and they can, through almost infinite credit extension and infinite money creation). Alternatively, bondholders (or, say, your uncle) do not have infinite balance sheets or printing presses with which to prop up asset prices collateralizing their credit. So, the only credit in a modern economy likely to be extinguished is non-bank credit, and at great pain to everyone else.

This process is harmful to the real economy. Excessive bank system leverage that further instigates excessive economy-wide leverage ultimately leads to debt destruction or re-arrangement – not in the banking system but in the real economy. Exhibit 1: today, where asset prices continue to increase while output languishes. Debtors are dutifully using their wages and revenues to service their obligations, in turn keeping bank assets marked at par, while central banks are creating new bank reserves to de-lever bank balance sheets. Nowhere in this scheme do natural economic or commercial incentives matter. Indeed, all this finance is crowding out saving and investment in plant, equipment and labor.

Stable Pricing => Unstable Economy

As central banks freely proclaim, their primary objective is stable prices. (Sadly, they do not see affordability across the greatest portion of society as a first priority, which would occur were they to observe the economy through a production model rather than a demand model. The Fed may try to claim that banking systems only fund commerce, and so production is not their jurisdiction. The Fed’s record, however, seems to show a total disregard for promoting a sustainably productive economy.)

In advanced economies today, the economic elephant in the room is the almost complete takeover of commerce by the financial and political dimensions, which has been promulgated by central bank policies. Consistently easy credit conditions for a generation increased demand and the general price level higher than they would otherwise be. Meanwhile, wages in these domiciles have not been able to keep pace because the value of labor is more objectively priced by the commercial marketplace.

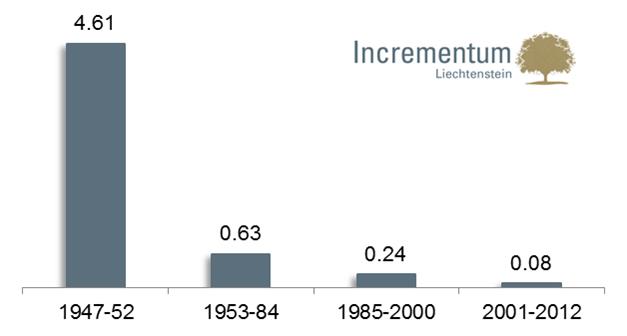

As a result, the scale and growth path of our economies remain reliant upon the continuation of easy credit policies – even when financing rates can go no lower, even while monetary authorities are directly subsidizing deficit funding, even when everyone in the marketplace and markets knows the frightening counter-cyclical impact were policy makers to stop, even when the efficacy of new debt on real economic output is diminishing. The graph below shows how pointless new debt issuance has become.[1]

Increase in Real GDP per Dollar of Incremental Debt

Policy makers in advanced economies seem to think they must do everything in their power to ensure prices do not fall, even if prices do not represent the sustainable real value of goods, services and assets, because falling prices would directly lower the value of debt (i.e., bank and pension assets), which in turn would greatly slow economic activity. Re-scaling (shrinking) economies to more sustainable price levels that would then naturally promote increased production is not a practical option. The political fallout from allowing this to occur makes it unfathomable in a monetary regime in which the money stock and price level is easily managed. Thus, it is wise to be bet against falling prices.

Bank on Inflation

While it may be wise to bet against falling prices, why should we bet on rising prices? The short answer is: because that’s the way we have always rolled and inflation is even more necessary now.

Inflation is entirely man made, created and administered by monetary authorities. Again, contrary to popular belief, aggregate demand cannot produce sustainably rising prices. Without bank system-manufactured inflation, population growth, innovation and economies of scale (i.e., productivity gains) would naturally drive lower the nominal prices of goods, services, labor and assets (though their values to society could remain the same, increase or decrease based on social preferences).

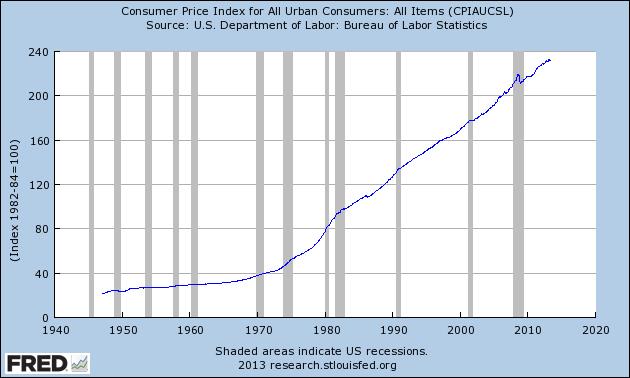

The current policy goal to inflate – in the US, Japan, and most advanced economies in Europe with the possible exception of Germany – should not be so startling. In economies where economic expansion is predicated on nominal asset price increases rather than production, generating inflation must be a policy objective. Note the unlikely consistency and stability of the US CPI growth rate, above. It is a triumph of monetary management over natural pricing. Particularly interesting is the threat of deflation in 2008 (the dip in the slope) and the impact of the Fed’s successful policy response to it (circled). Quantitative Easing was then and remains now meant to induce inflation. Indeed central banks exist to inflate, continually and unobstructed by social needs, wants, benefits or costs. Just look at the data.

Inflation, of course, is the loss of purchasing power of the currency in which we consume, save and invest. It is understandable that labor and pensioners might accept the loss of the purchasing power value (PPV) of their wages and saved wages when their homes and financial assets appreciate more than their PPV is decreasing. But what happens when their PPV is diluted at a higher rate than their assets appreciate? A case may be made that it still would not matter to them because most of the work force is also indebted (home mortgages, auto and student loans, credit cards, etc.), and without currency inflation they would not be able to service and repay their obligations. Inflation has become socially acceptable because so few of us are net savers and those that are invest in levered financial assets.

And so it was not surprising to note Chairman Bernanke’s recent testimony that the Fed considers inflation to be a part of the Fed’s mandate for price stability. From a policy perspective, price inflation equals price stability (see the graph above). However, the goal to inflate is an absolutely startling admission in the context of a zero-bound interest rate environment, which changes everything.

Theory Applied

The Fed (the BOJ, etc.) is effectively telling the markets that if it is successful in executing its policy to produce higher inflation, then near-record low market yields on all types of fixed income obligations – from Treasuries to high grade credit, mortgages to municipals, high yield junk to levered loans – would be vulnerable to either significant price declines or very negative real returns. Further, assets from homes to operating companies, with values that rely on the perpetuation of positive real returns on credit assets, including equity margin loans, are also quite vulnerable to significant re-pricing.

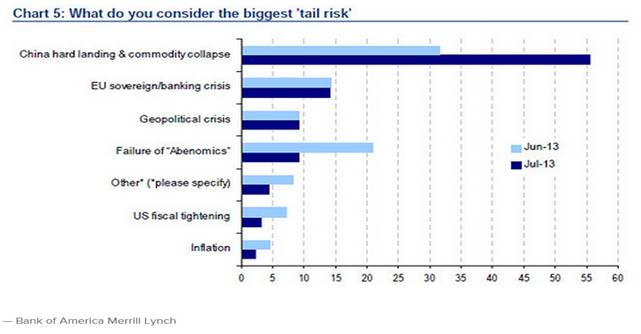

With that as a backdrop, please compare the graph of inflation over the last forty years on the previous page with the chart below showing the inflation expectations of BoA Merrill clients:

It seems inflation is not only the way advanced economies have rolled and remains a very strong policy imperative currently; it is also entirely unexpected in the markets.

Should equity investors be worried or excited about the need to inflate? We think the answer is yes! (J) Inflation will be the means to de-lever systemic balance sheets and it will affect different equities in different ways, at different times and in very different magnitudes. We believe the implied mandate, long precedence and demonstrated current willingness to inflate will ultimately sustain and increase the money stock, which in turn portends further nominal gains.

Since the NASDAQ crash in 2000 and the housing crash in 2007 (market manifestations of leverage bubbles bursting), governments, banks and financial asset investors have been bound by mutual incentives not to acknowledge the elephant in the room: nominal asset prices generally do not equal sustainable real value, adjusted for necessary future de-leveraging.

Necessary monetary inflation may ensure aggregate nominal asset prices will increase, or at least not fall for an extended period; HOWEVER, this is where the capital markets and the global commercial marketplace seem to take separate paths. In extremis – at times when the leverage cycle is peaking, as it did in 2000, 2007, and perhaps today – it should become obvious to all that aggregate demand is a second order driver of the general price level. The money stock takes priority. How else could governments, banks and households continue to service their obligations and support themselves?

As we can see in the daily papers, the only economic policy that seems to have any remaining efficacy is managing capital market and economic expectations. (That and rotating relative currency devaluations initiated by central banks, that allows their exporters report a few quarters of improving nominal earnings.) There is no sustainably positive economic impact in any of it, which implies that monetary authorities have become powerless to positively affect their economies in any meaningful way beyond illusory gains. Meanwhile, aggregate leverage is increasing in most advanced economies.

Inflating just enough not to produce the general fear of inflation is producing malaise, characterized by widening wealth and income gaps driven by the relative success of those closest to credit and levered assets in relation to those further away (or relative to those choosing not to leverage). The former generally produce far less than the latter, and the trick for monetary authorities is to continue executing accommodative policies amid declining real production and the general perception that nothing exceptional is occurring (and to not be blamed for widening income and wealth gaps). Nevertheless, the Fed cannot taper unless banks are willing to re-leverage rather than de-leverage. We expect any form of monetary or credit tightening to be summarily reversed once asset prices fall and balance sheets suffer, which they would quickly do. It is boxed. It will keep going and it will likely need to increase its purchases over time.

Our level of confidence is high. For better or worse (better generally for the investor class, worse for everyone else), the economic model for advanced economies over the last thirty years has been asset-centric rather than production-based (and levered-asset centric at that). Over the last twenty years, sustainable wealth from production has moved east. Production efficiencies have moved to emerging economies (precisely why they are emerging), while nominal balance sheets in advanced economies have expanded. Meanwhile, human and natural resources have continued to be consumed out of proportion in advanced economies, thanks to the great leveraging that has allowed advanced economies to exchange their unreserved digital credits for foreign labor, natural resources and production.

The point of economic and investment criticality today is the need to reconcile global value among two great forces: a) the accelerating momentum of economies with sustainable production and natural resources with b) the perception of economic omnipotence (and diminishing inertia) within credit-based, asset oriented economies. We think this reconciliation already has traction but has not yet been officially or broadly acknowledged.

We believe the product of this reconciliation should be a shift in the perception of value among assets – from those that may offer nominal gains in line with indexes today (beta), to those that would benefit most from systemic de-levering in real terms. As inflation is the only practical means of necessary de-levering, and since real and financial assets are not currently pricing-in inflation, significant risk-adjusted Alpha today is buried in the process of de-levering through inflation.

Conclusion

“Truth is tough. It will not break, like a bubble, at a touch. Nay, you may kick it about all day, and it will be round and full at evening.”

– Oliver Wendell Holmes, Sr.

In the current environment, in which general expectations for global inflation remain subdued, we do not expect Western commercial interests – ranging from large, listed corporations to corner restaurants – to take the bait by levering their balance sheets further in order to grow their nominal revenues. The graph on page 6 shows why – a unit of debt is nowhere near worth a unit of revenues, even with today’s low interest rates. Financial asset investors may continue to benefit in the short term while stocks and bonds remain well bid, but production and labor in over-levered economies should continue to wither.

When we take it to its logical conclusion, central banks cannot withdraw debt support (on a net basis) and so our baseless currencies seem highly likely to fail to provide sustainable purchasing power. (This happens as producers demand more currency units for their labor and resources, not when consumers drive prices higher by competing with each other for finite supplies of labor and resources.) Continued inflation of all global currency stocks is likely.

This implies to us that fundamental expectations of the inevitability of price inflation across borders and in all currencies must change, from unlikely to highly likely. When might this happen? We think it would have to be when politicians and monetary authorities believe it is in their best interest to let perceptions change. After all, there are no currencies not controlled by central banks, no competing currencies in which the global marketplace may find sanctuary. Neither are there global capital markets denominated in truly independent scarce currencies. Where is wealth supposed to go? Who will pay for natural and human resources? Micro-economies occurring around kitchen tables that collectively form true macro-economies (sans political incentives and policy mandates), will pressure authorities to act.

From a risk-adjusted value perspective then, we believe businesses and financial assets sponsored by levered investors, or businesses that rely on revenues from consumption by over-levered consumers, are particularly vulnerable. Their performance relies on the continuation and acceleration of unsupportable, irreconcilable household leverage. The only way to avert declining asset values and, ergo, bank system insolvency, will be to increase the general perception of future inflation.

We believe significant future Alpha will be harvested by allocating capital today to currently under-levered assets or assets that do not rely on others’ increasing their leverage. A sound bottom-up valuation approach should begin here. In order of expected performance, we think the best places to be presently are: 1) unlevered treasure – pure stores of global purchasing power, regardless of time, currency or future price numeraire; 2) less-levered price inelastic industries, and; 3) businesses with sustainable sales and margins independent of inflation rates, priced within currency regimes in which inflation expectations are likely to shift higher.

Finally, this piece marks QBAMCO’s final distribution. We, and many of our investors, will be joining the team at Kopernik Global Investors, a new yet very pedigreed value-oriented investment firm. We hope you have benefitted in some small way from these reports and we wish you all a very pleasant rest of the summer. Until we meet again,

Source:

Lee Quaintance & Paul Brodsky

QB Asset Management Company

pbrodsky@qbamco.com

What's been said:

Discussions found on the web: