My morning reading:

• Companies Embrace Low Interest Rates by Selling Bonds to Raise Billions (DealBook)see also Verizon Sells a Record $49 Billion Worth of Bonds (WSJ)

• Callaway: Lehman and the day the buck broke (USA Today)

• After Nasdaq disruption, regulators are urged to rethink decades-old technology (Washington Post)

• 5 Years After the Crisis: What Banks Haven’t Learned (Fiscal Times) see also Inside the End of the U.S. Bid to Punish Lehman Executives (DealBook)

• Does America need to support credit rating agency competition? (MuniLand)

• Raghuram Rajan: The Case for India (Project Syndicate) but see Are Emerging Economies Entering a Lost Decade? (Bloomberg)

• Behavioral Risk & Rebalancing (Capital Spectator)

• By making iWork free on iOS, Apple could pummel Microsoft Office (Quartz) see also Forget “Cheap”, The iPhone 5c Is Clearly The iPhone Jony Ive Wanted For iOS 7 (TechCrunch)

• Electric Schlock: Did Stanley Milgram’s Famous Obedience Experiments Prove Anything? (Pacific Standard)

• eejits: Record Labels Sue Sirius XM Over the Use of Older Music (NYT)

What are you reading?

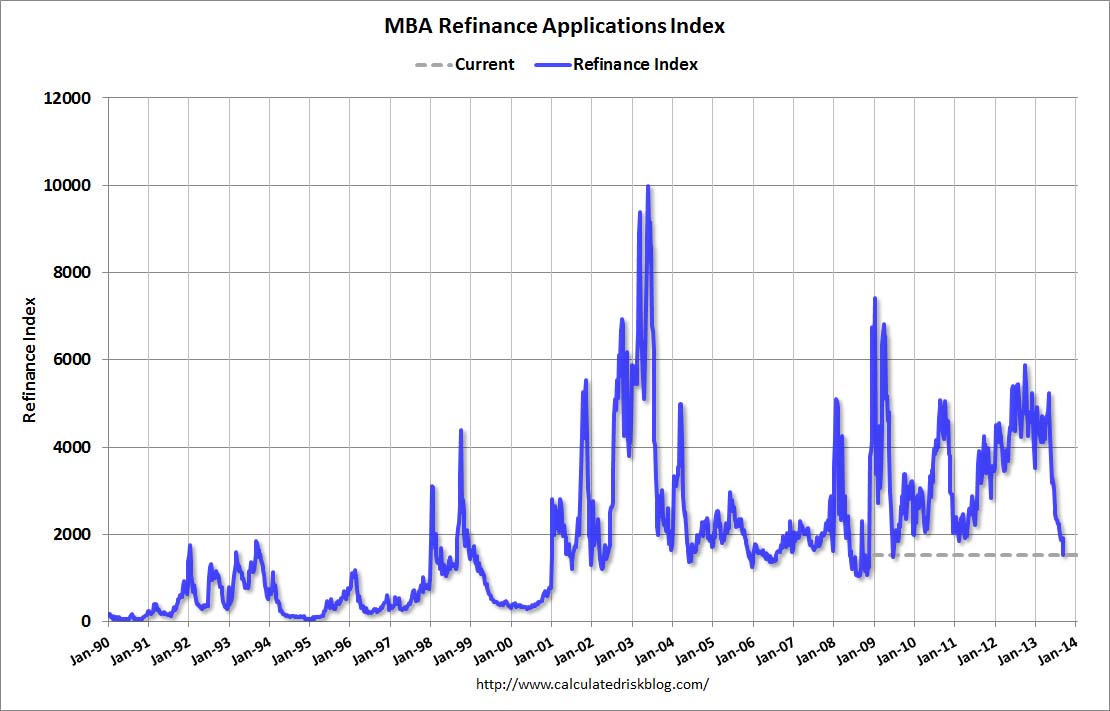

MBA: Mortgage Refinance Activity at Lowest Level since 2009

Source: Calculated Risk

What's been said:

Discussions found on the web: