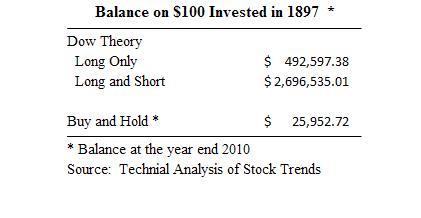

Reading through the classic textbook, Technical Analysis of Stock Trends, last night I stumbled upon a stunning stat comparing the returns of a strategy using Dow Theory versus buy and hold.

Using Dow Theory buy and sell signals would have turned an initial investment of $100 in 1897 into $492,597.38 by the end of 2010. This compares to a buy and hold strategy of $25,952.72, which even assumes buying the Dow low at 29.64 and selling at December 2010 close.

Of the 41,444 days from 1897 to 2010, the Dow Theory investor would have been on the sidelines 14,378 days, or 37 percent of the time. A nice place to be given some of the epic bear markets over the past hundred years. Imagine watching your portfolio evaporate during the “Hoover drawdown” of 1929-32 with the Dow falling 89 percent. No thanks!

Even more impressive is the return on trading both sides of the market, both long and short, using the Dow Theory buy and sell signals. This strategy would have turned the initial $100 investment in 1897 into $2,697,535.01 by the end of 2010.

The data ignores reinvestment and dividends. Stunning, nonetheless!

Source: Technical Analysis of Stock Trends

Also see: TheDowTheory.com

What's been said:

Discussions found on the web: