I was at an interesting dinner last, and amongst the very notable things discussed over giant steaks (yes, that is an actual dinner photo), ObamaCare came up.

Some of the attendees thought — like Senator Ted Cruz does — that it is a job killer, the bane of the economy. But that is essentially a political Macro argument, and not a true investing thesis. As we have seen this past year (Curse of the Macro Tourists), building an investment around a big macro theme has not been a particularly successful strategy. There are simply too many moving parts, too many unknowns, and to be blunt, way too much cognitive bias, for this to succeed as a strategy.

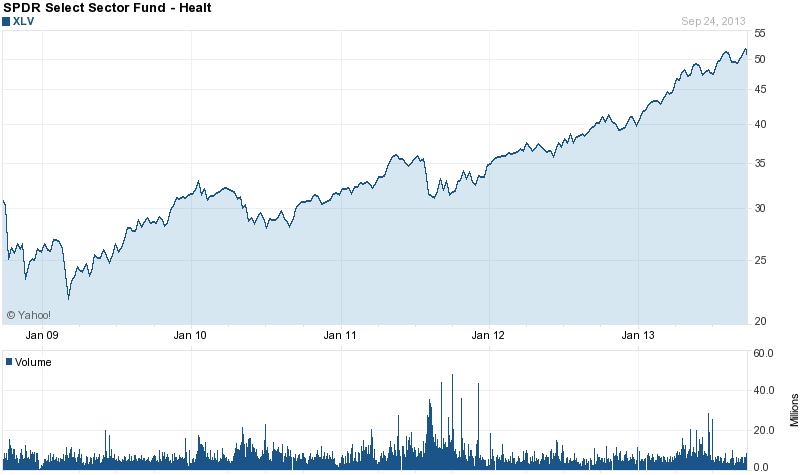

I have repeated counseled against focusing on politics in investing, and ObamaCare is no different. Indeed, my very first column for the Washington Post (February 6, 2011) was simply titled Why politics and investing don’t mix. Instead, smart investors have been thinking about how this insurance mandate will impact various sectors and companies. A few years ago, we discussed this and decided to overweight HealthCare sector via XLV ETF filled with Pharmaceuticals and Insurers and Hospitals; 3 years later, clients remain long, but we are now only modestly overweight the sector.

Lost in the initial political debate was the actual impact on insurance plans and hospitals: About 45 million uninsured people will now become new health care consumers (See Doctors Brace for Health Law’s Surge of Ailing Patients). The second factor was that hospitals will no longer be on the hook for free ER services, as they have for almost 3 decades.

Whats that you say? Hospitals are mandated to give away free services?

Yes, this is actually true. In response to some prior bad behavior from hospitals called “patient dumping,” a mandate for unfunded medical care was created. The Emergency Medical Treatment and Active Labor Act (EMTALA) was signed into law by Ronald Reagan. It mandated that “Hospitals provide care to anyone needing emergency healthcare treatment regardless of citizenship, legal status or ability to pay.”

You read that right, RR created a universal coverage mandate, forced the private sector to pay for it, and created the world’s most expensive, least effective Health Care program. Hospitals hated it, jacked up prices in response, and tried to spread the costs to everyone else.

Given that history, it is no surprise that Hospitals are quietly pleased with ObamaCare. Reall their stocks rallied after the Supreme Court ruled on the legality of the new rules. It should come as no surprise: They get to remove a huge cost they had no prior ability to control. They also get a massive number of new paying customers. Lastly, they have a much greater ability to determine who their patients will be than they had in the past.

And while I may be one person with one viewpoint, the broad Healthcare Index (see chart below) is up 200% + since the March 09 lows — and has done nothing but go up since ObamaCare was given Supreme Court approval (June 28, 2012) as well.

The Politics of ObamaCare are complex and confusing and partisan. The investing thesis — and results — have been anything but.

What's been said:

Discussions found on the web: