I have some good news and some bad news.

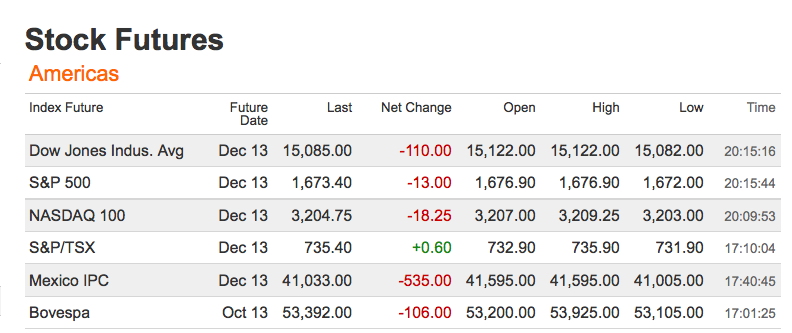

The bad news? Well, as the futures above shows, US markets are under lots of pressure, widely blamed on the economic impact of the likely shut down of government tonight at midnight. Shutting down nearly 25% of an already fragile economy is hardly the recipe for growth and advancement.

The good news is that so far, all we have is political posturing. History suggest that nothing happens until at least 12 hours after our September 30th midnight deadline. No one gets serious about any sort of deal before noon on October 1. At that point, political pressure on the House Republicans — from constituents, from Business leaders, and from elder statesmen — will start in earnest. A few days later, it can become more intense. We see the same sort of patterns with the debt ceiling limit as well (that’s schedule to hit at midnight October 17).

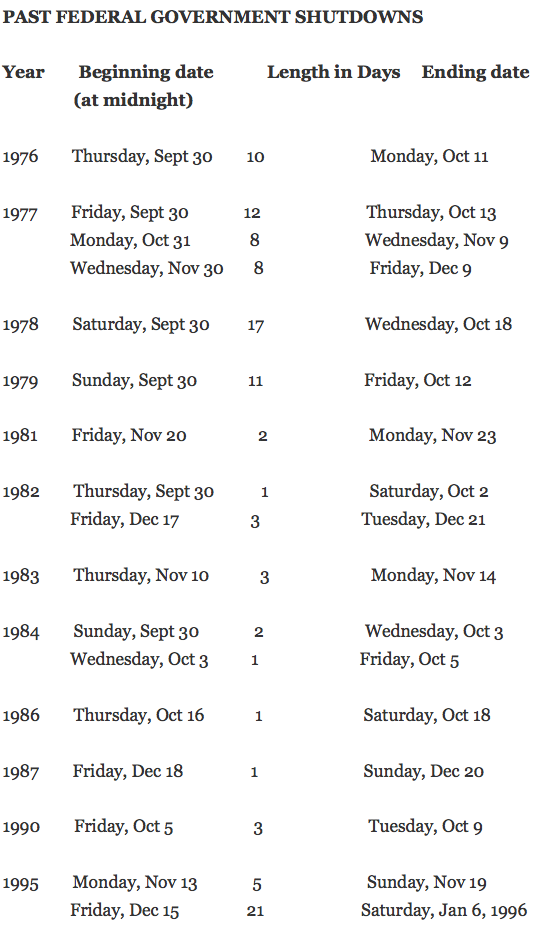

As NBC’s Pete Williams have reported, we have had 17 prior government shutdowns over the past 40 years, including 21 days in 1995 (table below). So while this feels like its new and unusual, it is actually more commonplace than most of us believe.

The odds favor a resolution in a matter of days or weeks.

See also:

• First U.S. Shutdown in 17 Years at Midnight Seen Probable (Bloomberg)

• The Odd Story of the Law That Dictates How Government Shutdowns Work (The Atlantic)

• Wall Street Uneasy in Face of Government Shutdown (Dealbook)

• Government shutdown would threaten fragile economy (Politico)

• House Republicans Push Obamacare Delay as Shutdown Nears (Bloomberg)

• Debt ceiling fandango: the key dates (FT Alphaville)

• Government Shutdown Near as House Votes to Delay Obamacare (Bloomberg)

• Krugman: Rebels Without a Clue (NYT)

• ‘Political Shenanigans’ Take Center Stage, Hitting Risk Appetite (MoneyBeat)

• The Right Gets Its ’60s (NYT)

What's been said:

Discussions found on the web: