@TBPInvictus

I recently got an education on a loophole in a NYC program that is designed to protect seniors on fixed incomes from rising rents.

The Senior Citizen Rent Increase Exemption Program claims that: “Tenants who qualify for the Senior Citizen Rent Increase Exemption (SCRIE) Program can have their rent frozen at their current level and be exempt from future rent increases.”

The criteria are:

- Must be at least 62 years old;

- Rent an apartment that is regulated by the Division of Housing and Community Renewal (DHCR) (i.e. rent controlled or rent stabilized apartments or hotel stabilized);

- Have a total annual household income of $29,000 or less and;

- Pay more than one-third of the household’s total monthly income for rent.

Now, before going any further, I’ll point out that the NYC Rent Guidelines Board [pdf] recently allowed a 4% increase for a one year lease because, well, inflation is running at less than half that amount. Which is to say I haven’t the foggiest as to why such a large increase was allowed. Not saying anything funky went on or anyone is in anyone else’s pocket. Of course, not saying it didn’t and they aren’t.

So, here’s the story:

I was conversing with an elderly widow who lives on a fixed income. Her lease is up and a one-year renewal, as mentioned above, will run her an additional 4%. Her landlord also did some major renovations to the building, which ran almost $4MM, and has applied for a Major Capital Improvement (MCI) adjustment to tenants’ rents to recoup the expense. This would run the widow an extra $150/month on top of the 4% rent increase and, importantly, would be included in her base rent for future lease renewals. All told we’re looking at over $200/month. The bottom line is that these additional monthly expenses are a burden on a senior living on a fixed income, and on this senior in particular. And they’re exactly the kind of burden that the SCRIE is supposed to relieve (both the renewal increase and the MCI).

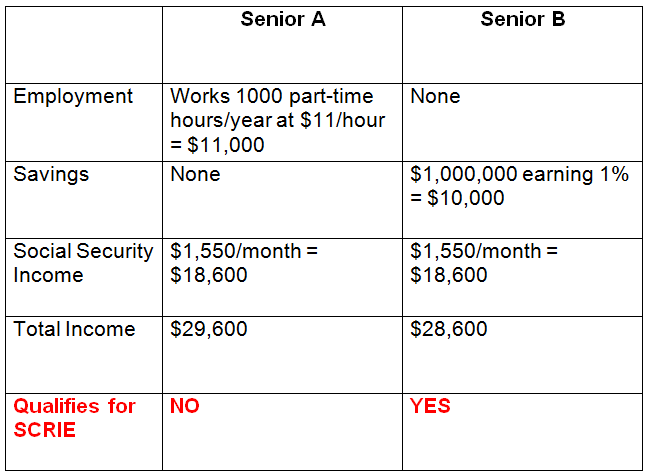

So what’s the issue? Let’s take a look at two hypothetical seniors and see exactly what the problem is. Assume our two seniors qualify under 3 of the 4 criteria listed above and our test relates to the fourth:

Not very hard to see the inequity here – a senior with no savings and some income from part-time work is ineligible, while a non-working senior with a tidy nest egg qualifies. And while the example above may seem extreme, I don’t believe it’s as far-flung as it appears. Using income – instead of means, assets, net worth, resources, what have you – seems an incredibly foolish way to administer this plan. That said, $29,000/year is an absurdly low level of income to expect anyone – senior or otherwise – to reside within the five boroughs of New York City. And yes, I know there are other local/state/federal plans that people “take advantage” of. This story is not about that – it is the opposite, about people who should qualify, who should be protected, being excluded on the basis of poorly structured legislation.

I called any number of politicians’ offices about this, including (but not limited to): Jeffrey Dinowitz, Jeffrey Klein, Oliver Koppell, and several more. Shamefully, I got little more than lip service, with each office acknowledging the problem – and readily conceding that thousands upon thousands of seniors (many their own constituents) are suffering because of the it – while quickly pointing out (for reasons that elude me) that a fix would be hard to enact and take forever.

What I’d guess is that this loophole is the result of poorly thought-out and written legislation along with legislators who perhaps did not envision a zero-interest rate environment ever becoming a reality. But it is. And it has created an environment in which some seniors are favored while others are disadvantaged. It is also the government creating a very perverse incentive for seniors to consider asset re-allocations that they would surely not otherwise consider, i.e. sell those widows and orphans stocks in your nest egg – T, VZ, ED, etc. – in favor of cash to eliminate that income stream you’ve been relying on. And what senior is really interested in doing the math (which isn’t really even doable) – speculating about potential future rent increases versus keeping or sacrificing all or part of his/her dividend income stream to qualify for a rent freeze? And what about the capital gains implications? Are you kidding me? This cannot be right.

This is very far afield from my day job, though I think I researched everything diligently enough – and got enough confirmations from folks who know this provision – to know WTF I’m talking about. If anyone has any corrections or suggestions, by all means drop ’em in comments. To NY State and NYC legislators: You should get on this, and quickly. It matters – and has for all the years you’ve neglected it. It is shameful, and no way to treat our seniors.

What's been said:

Discussions found on the web: