Dysfunction Is Limiting U.S. Position Abroad, Observers Say; ‘Sadness From Our Trading Partners’

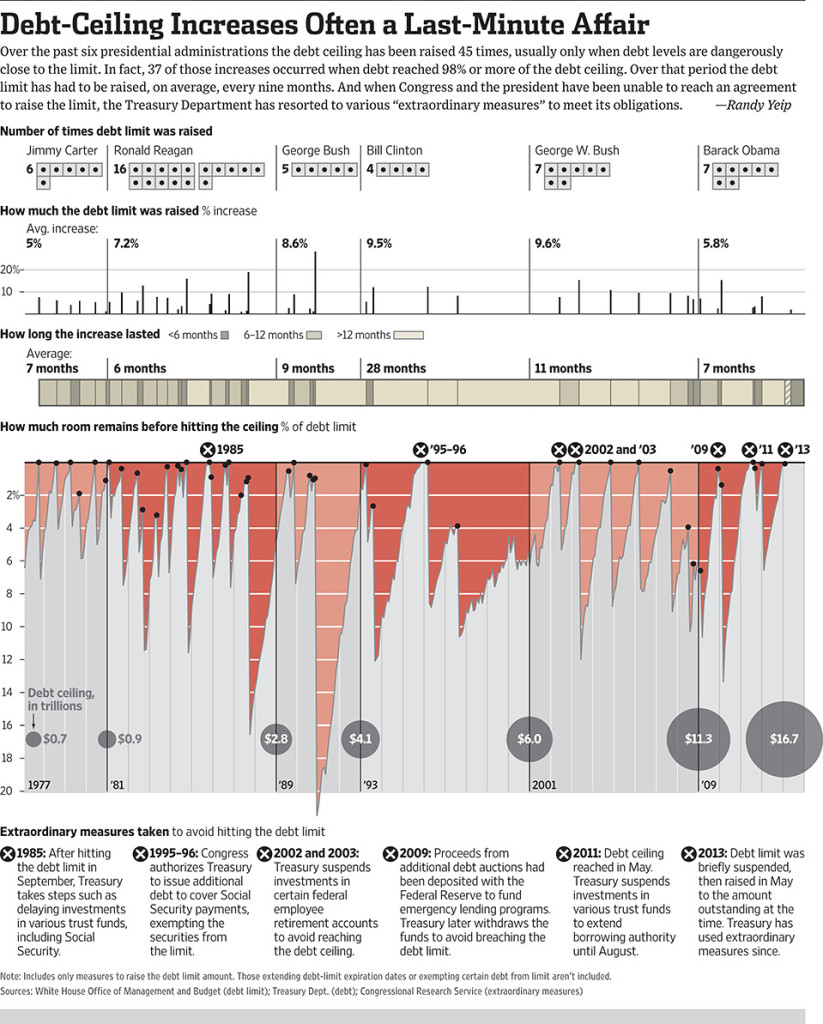

click for ginormous graphic

Source: WSJ

Here is the problem with using the debt ceiling as a negotiating tactic: It does permanent, long lasting damage to the reputation of the US, and hastens the day when the US Dollar is no longer the world’s reserve currency.

The damage has ALREADY made US financing more expensive, impacted consumer confidence, and shaved a few bps off of GDP. The lasting ramifications of this are even greater, and future generations will spit expletives whenever they mention the 113th Congress.

The Tea Party has made it clear: Ideology first, party second, country last. They should be treated as hostile adversaries in all future negotiations.

See also

Why the U.S. Should Be Downgraded (MoneyBeat)

Salmon: The default has already begun (Reuters)

The Myth that U.S. Has Never Defaulted On Its Debt (TBP)

The debt-ceiling doomsday device (FT.com)

Some are born solvent, some achieve solvency, and some have solvency thrust upon them (FT Alphaville)

Contra:

Stop Fretting: The Debt-Ceiling Crisis Is Over! (New York Magazine)

Source:

Fiscal Uncertainty Chips Away at U.S. Prestige

Dysfunction Is Limiting U.S. Position Abroad, Observers Say; ‘Sadness From Our Trading Partners’

Thomas Catan

WSJ, October 15, 2013

http://online.wsj.com/news/articles/SB10001424052702304330904579137880639455254

What's been said:

Discussions found on the web: