A touchstone of my investing philosophy is the importance of investors tuning out what is unimportant. Lose the News is the counter-intuitive way I first expressed this idea back in 2005. However, since then, I have repeated several variations on this theme: Whether its The Price of Paying Attention or advising people to Avoid the Noise or simply counseling investors to focus on What They Can Control, these overall themes have been very consistent.

The signal to noise ratio as of late has been nearly overwhelming — all noise, no signal — which, in no particular order, includes: Syria as the potential flashpoint, then the Summers/Yellen horse race, followed by more European Bank problems, then the US political situation, yet another dust up between Greece and Germany, then the Tea Party war on ObamaCare, no wait government shutdown, no wait the debt ceiling, grabbing center stage.

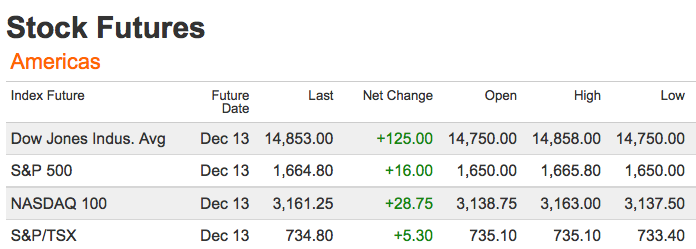

While the market’s up/down, back and forth make it appear over the short term that these things are oh so important, the simple reality is they are utterly meaningless. There is ALWAYS going to be some crisis, some news event, some MOST IMPORTANT THING IN THE WORLD RIGHT NOW, and always has. I am here to tell you that all of these “earth shattering events” each end up being tears in the rain — a momentary emotional blip of little consequence, mostly international back fence gossip, with next to no significance to the overall global economy. They are all noise, no signal, at least in terms of what matters to the intelligent investor’s perspective. As an example, consider the simple truth that despite this immense distraction, we are spitting distance from all times highs on S&P500.

So much for trading the macro news flow.

This theme was repeated by lots of very smart and insightful people at our conference this week. Regulars on FinTV admit how unimportant most of what goes on air actually is (I call it useless filler); our flawed cognitive views leads us to putting way too much emphasis on these unimportant issues,, especially when they are more recent. The charming and delightful Art Cashin even told the lesson he learned early in his career as to why a reports of a nuclear attack offered the smart trader a buying opportunity.

Thus, while I am not suggesting we are past whatever idiocy the jackals in Washington DC have dreampt up — and there always exists the possibility it all comes tumbling down in a disastrous Mad Max canned food and bottled water dystopia — I doubt thats the likely outcome. Indeed, investing history has taught those who pay attention to such things, however counter-intuitive it may seem, that tuning out the noise, and staying with the higher probability, most likely outcome is the way to go. I suggest you consider doing the same.

Remember, the end of the world bet has been a money loser since the beginning of time.

What's been said:

Discussions found on the web: