Source: Calculated Risk

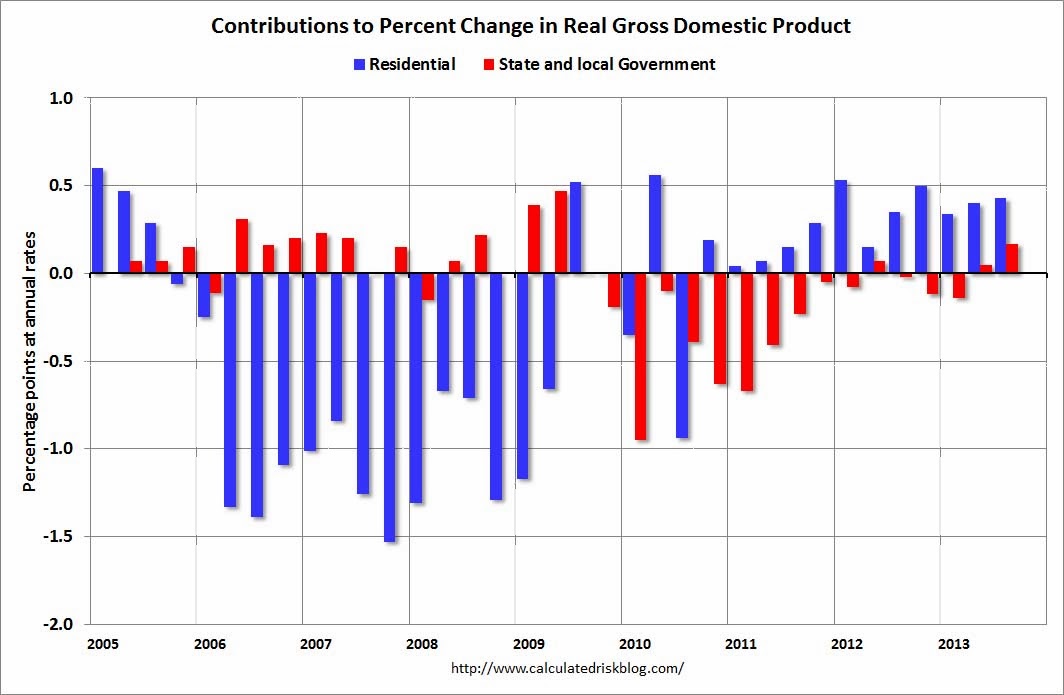

After four years of contracting state and local governments, has the drag on local economic activity finally ended?

That appears to be the case, based on recent hiring and spending trends for many state and local areas.

Bill McBride of Calculated Risk notes that this is a significant change that moves regional governments from “being a headwind for the economy to becoming a slight tailwind.” (Note that this is not uniformly distributed, and certain states have done much better than others).

The primary reasons for this are housing and employment. Residential investment was a tremendous drag on economic activity from 2005 through 2010. That has since reversed, because of tax incentives and the extremely low rates engineered by the Fed’s quantitative easing.

From 2009 to early 2013, state and local governments were also a drag on economic growth. There is a direct correlation between improving residential real estate markets and local governments fiscal health. As property registrations, mortgage tax filings and certificates of occupancy increase, so too do local governments coffers improve.

With improving housing comes increased local government spending. Net net, state and local governments are no longer an economic drag.

Similarly, state and local government payrolls have stopped falling and appear to be turning up. From 2009 through 2012, more than 664,000 jobs were cut from payrolls. Typically these are teachers, firefighters, police officers and local government positions. So far in 2013, regional governments have added 74,000 new jobs. Not a giant boost, but no longer a negative.

McBride adds “I think most of the recession related state and local government layoffs are over … austerity is over.”

The caveat? Federal government layoffs continue to be a drag on the economy.

~~~

What's been said:

Discussions found on the web: