Source: RealtyTrac

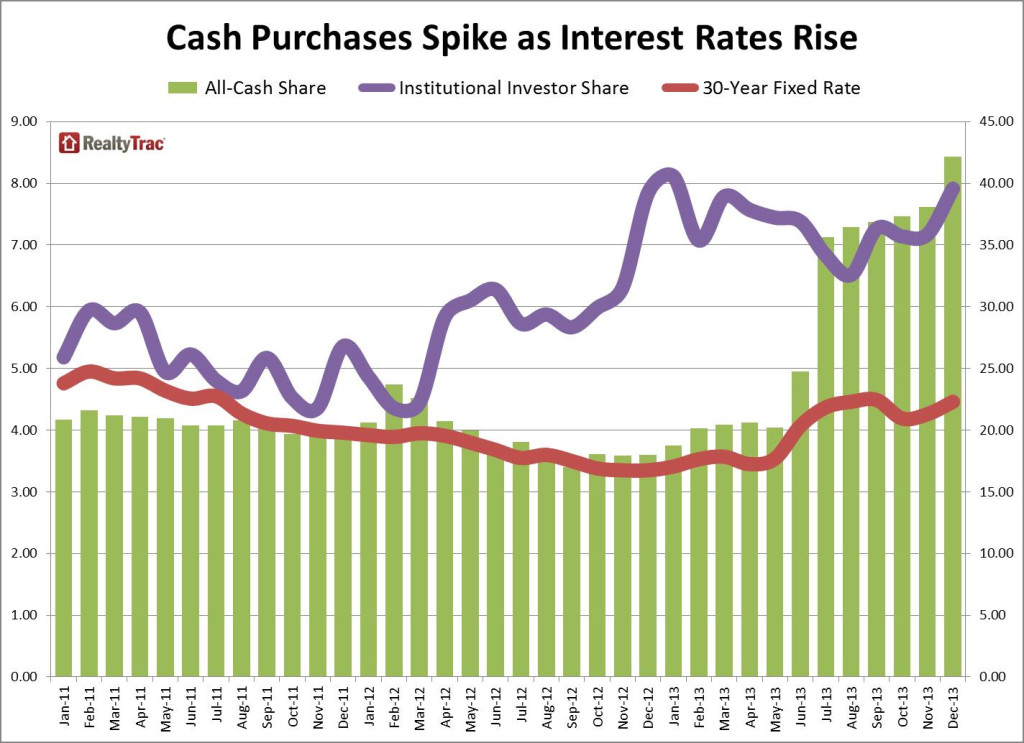

The chart above comes form the RealtyTrac Residential & Foreclosure Sales Report. It should come as no surprise that as rates rise, so too do all-cash purchases.

There are a few significant factors worth noting:

1) Last year, institutional investor purchases for residential properties (single family homes, condominiums and townhomes) accounted for 7.3 percent of all U.S. residential property purchases. This is up from 5.8 percent from in 2012 and 5.1 percent in 2011.

2) Median price of a distressed residential property — in foreclosure or bank-owned — was 38 percent below non-distressed property median ($108,494 versus $174,401) in December.

3) Bank-owned properties (REO) accounted for 9.3 percent of all U.S. residential sales last month, essentially unchanged from a year earlier (9.2 percent in December 2012).

What's been said:

Discussions found on the web: