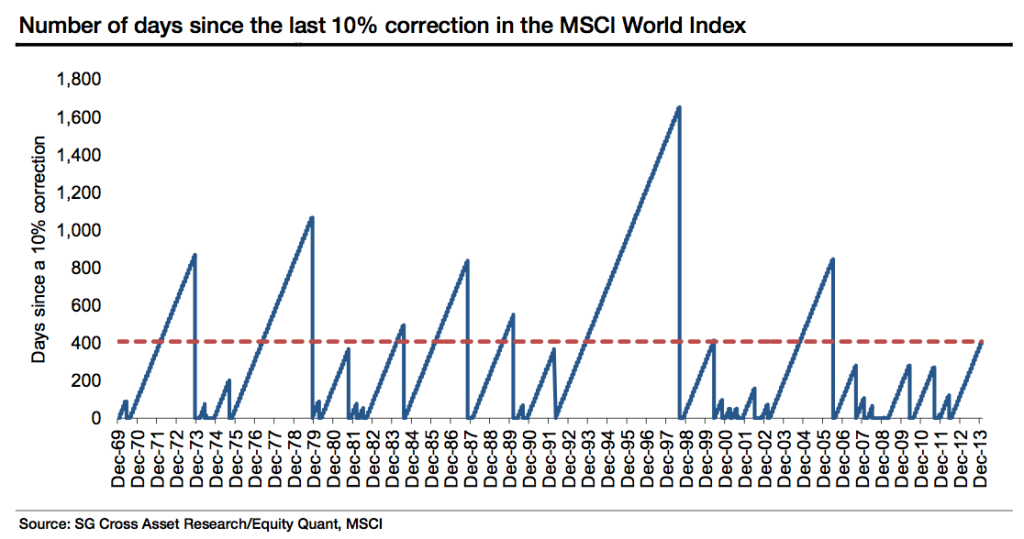

From Société Générale strategist Andrew Lapthorne comes the chart above, and the observation that “It has been 408 days since the last 10% correction in the MSCI World index, the 8th longest period on record.”

As the char above shows, this is just about the median length of time between corrections. The mere fact that we have not had a 10% or worse correction for a long time tells us very little about the state of the secular bull market, but it does make the odds of that 10% correction a little better as time goes on. Note this is an inevitable truth in any periodic event.

Continues here

What's been said:

Discussions found on the web: