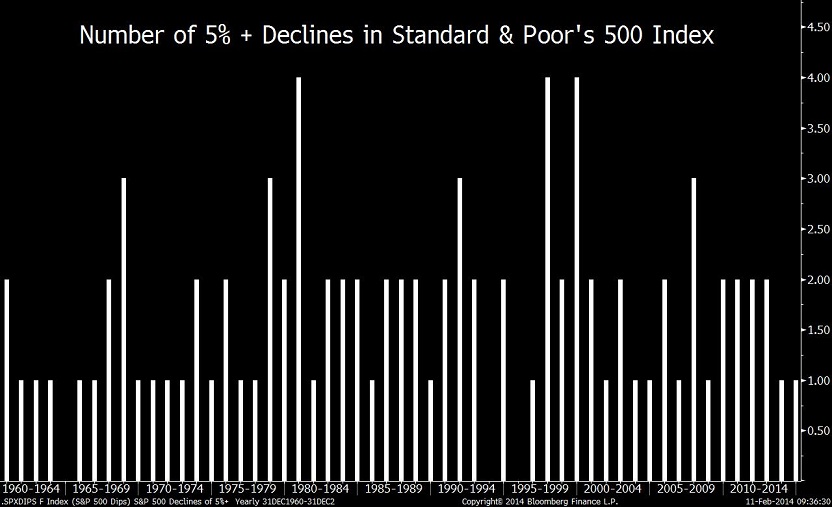

The CHART OF THE DAY shows the number of times that the Standard & Poor’s 500 Index declined 5 percent or more during each year between 1960 and 2013, according to data compiled by Deutsche Bank. In 22 of the 54 years, only one retreat crossed the threshold. Another 22 had two losses of that size.

This year, the S&P 500 closed at a record on Jan. 15 and then dropped 5.8 percent through Feb. 3. The size of the loss approached an average of 7 percent for the index’s dips since 1957, which Bianco cited in a Feb. 7 report.

Losses like the latest one “usually stay under 10 percent and are quick,” the New York-based strategist wrote. The S&P 500 reached its low in 12 trading days, less than half the average of 28 days since 1957.

Bianco wrote that he’s unsure which way stocks will go in the next 5 percent-plus swing, although he added that higher oil prices are encouraging. Crude settled at more than $100 a barrel yesterday for the first time this year in New York trading after rising 9 percent from a low set last month.

“We wait for more information” before turning bullish, he wrote, citing data that showed weakness in U.S. employment and manufacturing. During January, fewer jobs were added than economists in a Bloomberg survey predicted. A manufacturing index from the Institute for Supply Management matched its biggest one-month drop in the economy’s current expansion.

What's been said:

Discussions found on the web: