Source: JP Morgan Guide to Markets 2Q|2014

Have a look at the chart above. It is from the quarterly chart book from JPM (which I have been referencing for years).

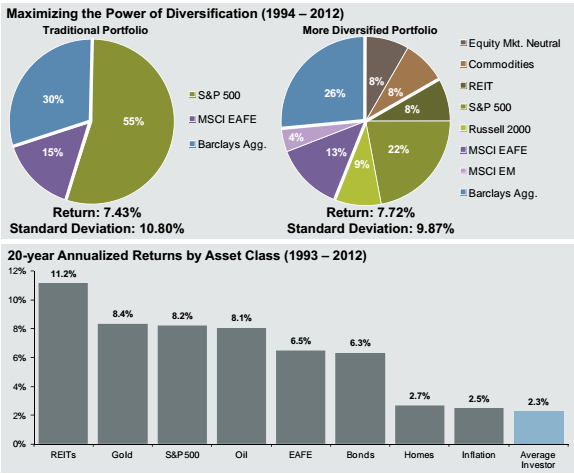

Average annual returns for individuals over the past 20 years? 2.3%. That fails to even keep up with inflation. REITs, commodities, equities and even bonds all wildly outperform the average retail investor.

The bottom half of this graphic shows what happens when investors are left to their own devices: They engage in emotional decision-making (AKA Fear & Greed), they “performance chase,” they fail to have any form of risk management in place, pay high fees, and exhibit an almost willful lack of discipline.

What's been said:

Discussions found on the web: