My Sunday Washington Post Business Section column is out. This morning, we look at a famous aphorism from Sir John Templeton. The print version has the hedder When is ‘this time’ really different? while the online version used the fuller Investors must recognize what ‘this time it’s different’ really means.

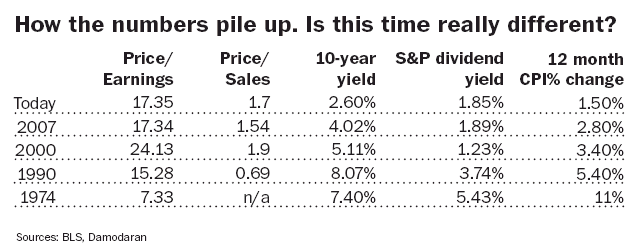

The column tries to draw the difference between the psychology of when investors are rationalizing paying anything in a speculative bubble versus the times when there are actual differences in fundamental economic metrics. Despite the differences between these two situations, people apply — and mis-apply — Templeton’s famous aphorism.

Here’s an excerpt from the column:

“So what is the formula for recognizing what “this time it is different” means? (And why is it that it’s never different? The answer, I believe, is two parts math, two parts psychology.

The math part begins with the traditional formula for valuation. In its most simple expression, it is price relative to earnings, or the P/E ratio. That is the oversimplified version. There are many other factors that also impact valuation: economic growth, inflation, interest rates, cost of capital, investment options, etc. And there are countless variations of how to measure it. Last year, Merrill Lynch’s quant team looked at 15 metrics that measured equity valuation — but the basic formula is typically a version of price relative to a profit related metric.”

I really like what the Post did in the dead tree version of the paper — the chart below, and the headline on the jump — Think this time is different? Take your temperature. Then check the data.

>

click for ginormous version of print edition

Source:

Think this time is different? Take your temperature. Then check the data.

Barry Ritholtz

Washington Post, May 18 2014

http://wapo.st/Tc59Gz

What's been said:

Discussions found on the web: