Source: BCA

Today’s chart comes to us from Chen Zhao of the Bank Credit Analyst, who writes in a research report:

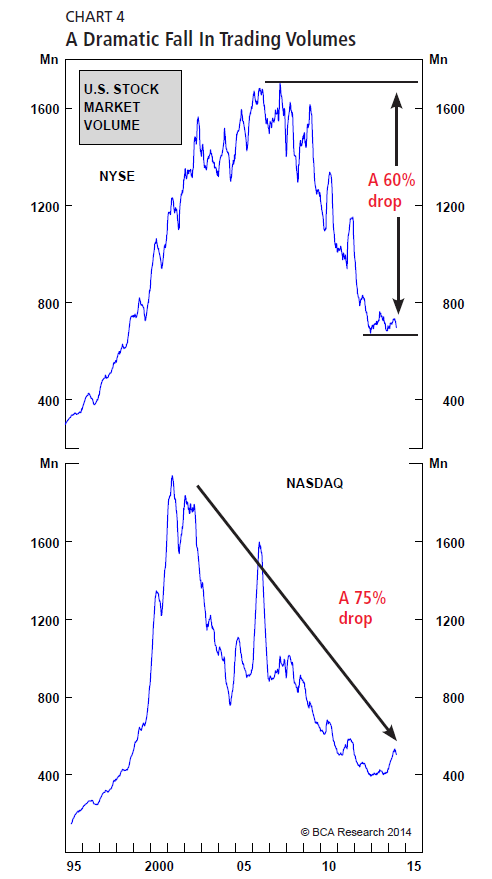

The financial services industry have (sic) begun to feel the pinch of the fallout from low volatility and zero interest rates. The average return delivered by hedge funds has fallen sharply since the beginning of the year. Pension funds are under pressure because of highly depressed bond yields. The brokerage and investment banking industries have also been under siege by the rapid decline in trans-action volumes and deal flows.

I can identify at least three forces, other than Federal Open Market Committee policy, driving trading volume lower.

What's been said:

Discussions found on the web: