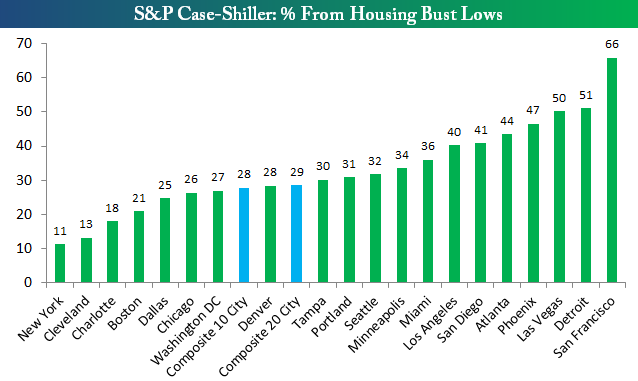

Below is a look at how much home prices have increased for each city tracked by S&P/Case-Shiller since the housing bust lows.

As shown, San Francisco remains by far the biggest winner with a gain of 66%. Detroit and Las Vegas have seen the 2nd and 3rd largest increases in price at 51% and 50%, respectively. At the bottom of the list is New York with a gain of just 11% off of its lows.

Source: Bespoke Investment Group

Bespoke:

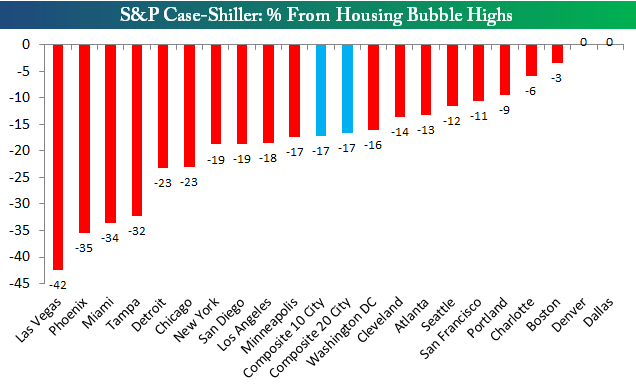

Las Vegas has seen home prices rise 50% off their lows, they’re still 42% below the highs they made during the housing bubble of the mid-2000s. Below is a chart showing how far each city is from its bubble highs in price. After Las Vegas is Phoenix at 35% below, followed by Miami (-34%), Tampa (-32%) and Detroit (-23%). The two composite 10-city and 20-city indices are both roughly 17% below their all-time highs.

There are two cities that have already eclipsed their prior bubble highs — Denver and Dallas. Three other cities are within 10% of their highs — Boston, Charlotte and Portland. San Francisco is just outside of the 10% mark at -11%.

Source:Bespoke Investment Group

What's been said:

Discussions found on the web: