Source: Bespoke Investment Group

The European Central Bank announced its latest — and belated — program of quantitative easing last week. The ECB made fresh commitments to buy a series of asset-backed securities (ABS), various bonds and expanded its previously announced Long-Term Refinancing Operations (LTROs).

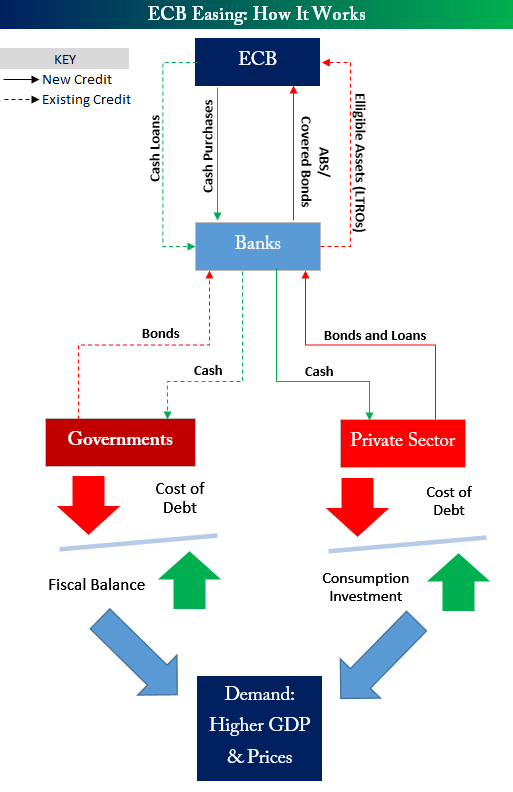

The ECB’s brand of quantitative easing is an incredibly complex process. I could try to write 2,000 words explaining how the ECB uses bonds, loans and cash to prop up the European economy, stimulate lending and lower the value of the euro. But that mind-numbing exercise isn’t necessary thanks to the flow chart above from Bespoke Investment Group.