Source: Deutsche Bank Securities

Torsten Slok, chief international economist for Deutsche Bank AG, warns about the hawks on the Federal Open Market Committee getting too, well, hawkish.

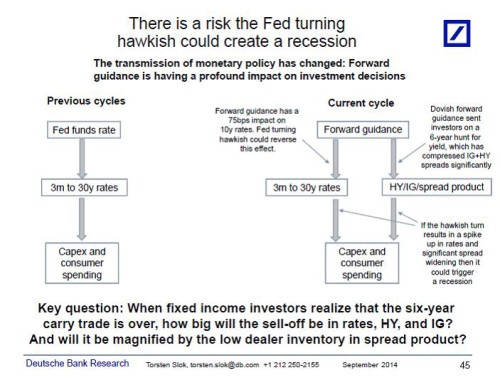

The flowchart above shows the different transmission mechanisms of monetary policy. Slok uses it to highlight the widening spread between investment-grade and high-yield junk bonds.

If and when investors decide that the Fed’s extraordinary accommodation is ending, a bond selloff could occur. Such a sell-off might affect consumer spending and corporate capital expenditure. According to Slok, if the selloff is large enough in various fixed-income markets, it might even cause a recession.

The FOMC announcement comes today at 2:00 p.m. (Washington time).

What's been said:

Discussions found on the web: