Source: Research Affiliates

Rob Arnott of Research Affiliates writes:

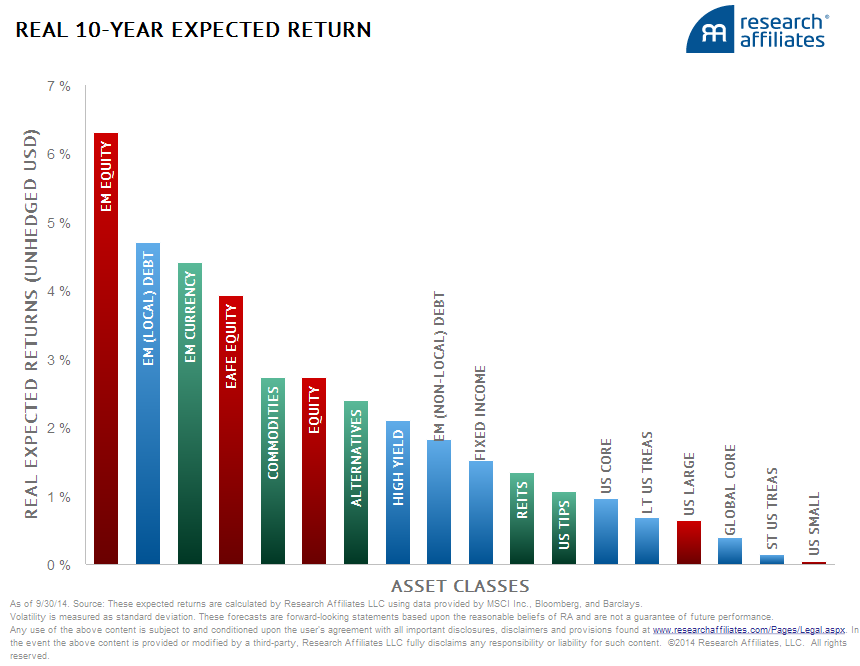

In a world of low bond yields and slow economic growth, historically realized 5-6% real (7-8% nominal) asset class returns may be unrealistic expectations for the future.

In other words, assets with above-average valuations may not deliver the sort of returns people came to expect before the credit crisis.

What’s an investor to do?

Thankfully, we have a chart.

What's been said:

Discussions found on the web: