From Torsten Slok, Deutsche Bank:

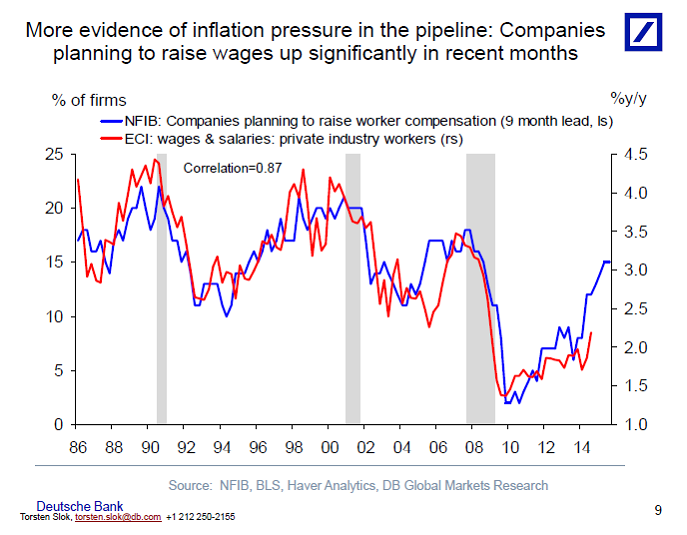

The next ECI will be released on Jan 30 and the NFIB data that just came out points to more upward pressure, see chart below. Also, remember that the wage data used in the Fed’s FRBUS model of the US economy is the employment cost index and not average hourly earnings.

All the way up to the mid-80’s lows !

… Mr Glass-Half-Empty

That is what happens when you have disinflation, nominal wages decline.

Disinflation does not seem to have hurt the 1%, perhaps the 99% are receiving a double whammy …

With income, you have to factor in non-cash contributions as part of the overall package. The single largest contribution – and one that a whole lot of employees are quickly learning how much – is health insurance. Which, because of our current tax code, was an excellent in lieu of wages alternative: employees weren’t taxed on the money spent on insurance, companies could write the expense off and therefore reducing their taxes.

Nevertheless, employee health insurance plans and their steadily rising costs did have an effect on wages.

In general, non-monetary compensation to employees tripled in cost during the period shown in the above chart. Including FICA, it’s a rather large percentage of employee cost; and that explains to a good extent, I think, wage stagnation over the years.

This argument seems to assume that employer health care benefits have remained constant over the past decade or so, but in every company I have had the opportunity to observe health care benefits, the employee is assuming a greater role in paying for them (by having their employer-provided health care benefits reduced) — which does not say that employer health care costs have not risen, but rather that it is difficult to make simple statements about employee total compensation when all the components of employee compensation are changing relative to each other.

Doubtless, some portion of the decline in employee wages has been due to rising benefit costs, but I suspect that if one looked at a similar chart of employee total compensation, it would lag far behind corporate profits and CEO compensation.

Not to mention the fact that health care benefits are not fungible. My wife has always had a better benefit package than I, so I opt out of mine. Sure, I don’t pay the (increasing) employee contribution, but is my salary compensated for the employer’s savings? Of course not.

Doubtless many people that visit this site are of the wealthier variety, with single earner households. However, for much of America, dual earners are a requirement of the “middle-class” lifestyle. I’m certain that our situation is far from unique.

When United Air is about to lay off 2000 employees, just as the oil prices have fallen 55% and the load factor is near all time high, somehow I doubt the truthiness of this survey.

http://fortune.com/2015/01/14/eventbrite-founder-interview/

lol to this post. there were airline layoffs in the late 90’s.

Is this time any different than the years 2004 to 2006, when the chart looked the same as now? I will believe it when Lucy lets Charlie kick the football.

not sure wages will grow again with all of the consequences of that. companies have got it so that they can control it, by offshoring any new jobs, or by automating those they can’t, and of course there is that large reserve of those that have part time, or not looking to fill any jobs that dont fit the other controls, plus of course there is the likelihood that employees cant get pay raises because they dont believe they can, so dont ask. plus its not like demand is taking off either (being held down by consumer lackluster spending. and no interest in making that up with credit for low incomes)

Upward pressure. Right. We’ve been hearing this same song for the last 3 years. I’ll believe it when I see it.